Kung meron na po kayong account sa SSS online via sss.gov.ph, pwede na po kayong umutang…

How to qualify for SSS salary loan?

Dapat meron na po kayong total na 36 contributions. At, if hindi straight ang inyong pagbayad, at least merong 6 months na paid contributions sa nakalipas na isang taon or 12 na buwan.

Again, para klaro, kailangan po ninyong mag-signup ng account on sss.gov.ph, at pagkatapos noon, pwede na kayo mag-apply sa salary loan given na umabot na nga kayo ng 36 contributions since the beginning.

Pwede via check o cash card ang pagkuha ng pera. Okay naman ang check kaso mas matagal dumating, at need pa ipa-encash sa bangko… mas maganda ang cash card… if you have an existing Unionbank account, pwede na e-enrol sa inyong account sa SSS… yun din ang ginawa ko. This would be my 4th loan with the SSS…

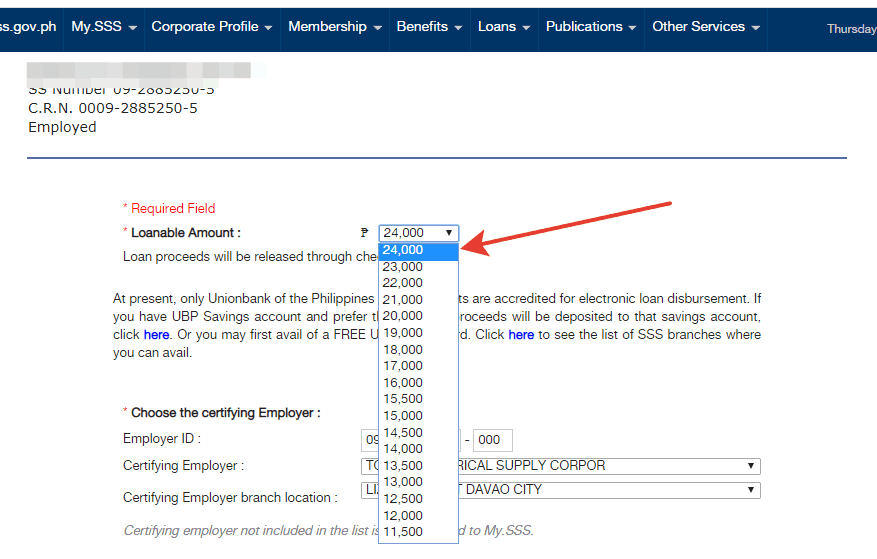

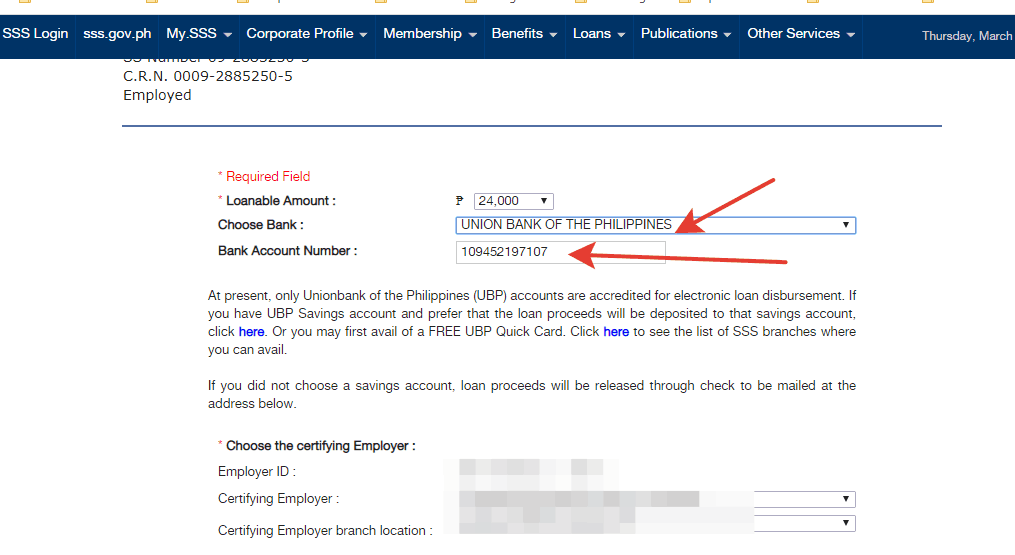

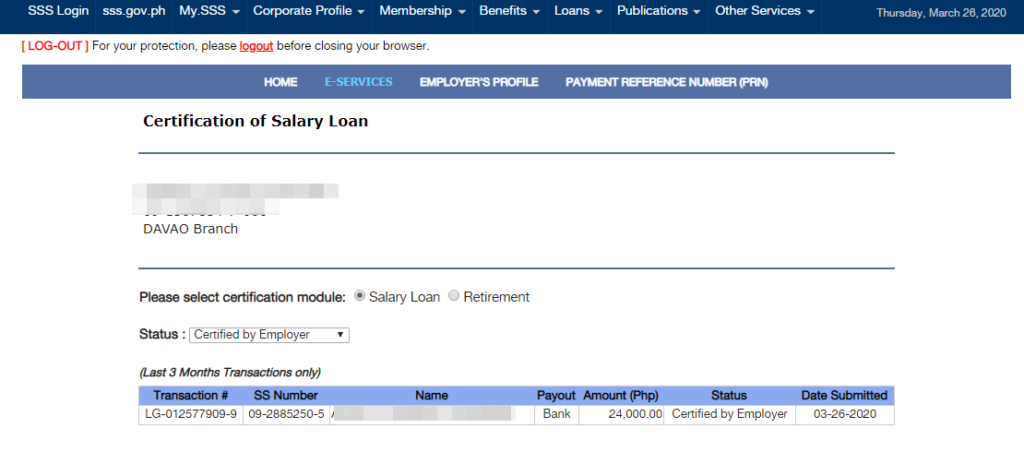

Dahil more than 72 contributions na ako, I could avail for the two-month loan… Yung contributions natin sa SSS ay may equivalent yun na monthly salary credit… so sa akin, times 2… so, sa aking offline job, ang equivalent na salary credit ko ay 12K, so I could avail a 24K loan… anyway, reloan ko ito, kaya hindi ko rin makukuha ng buo ang 24K, pero malaking tulong na arin…

Sa SSS (Social Security System), pwede kasi mag-reloan kapag 50% or less na sa principal loan value ang balance…

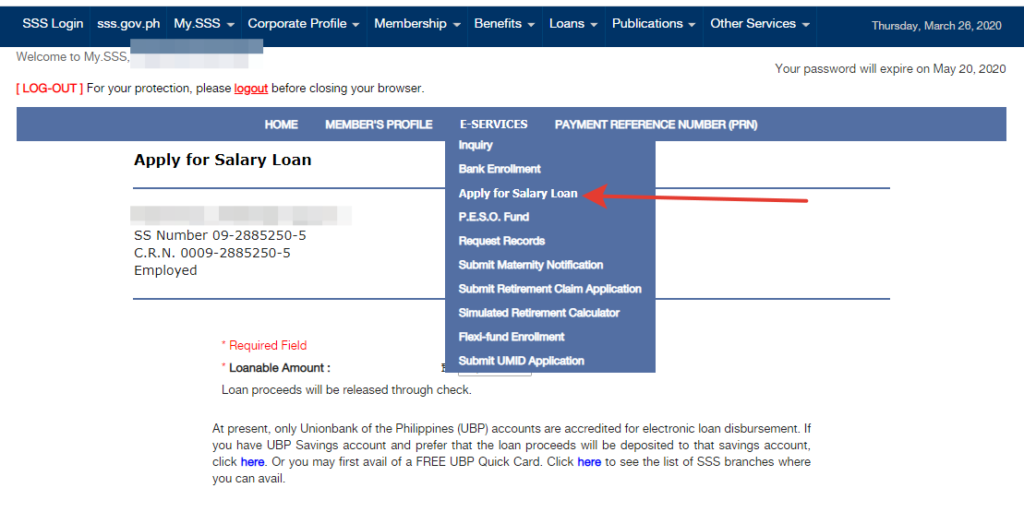

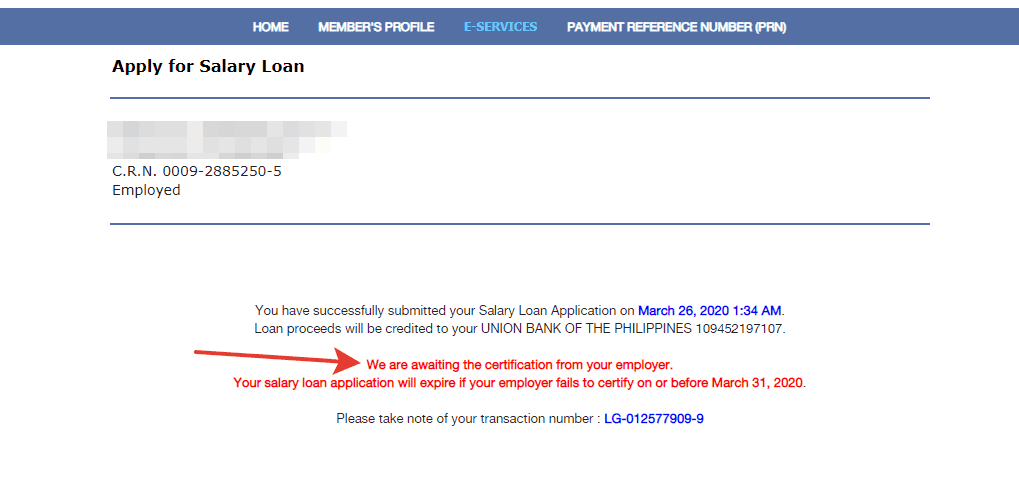

Ibabahagi ko ang mga screenshots ng aking online loan application with SSS para magiging gabay ninyo…

Under E-services menu, piliin ang “Apply for Salary Loan”…

Yung max amount nga sa akin is 24K, but I could choose lower amounts… reloan nga ang aking case, kaya pinili ko ang 24K para at least medyo malaki-laki din ang pwedeng ma-disburse sa akin…

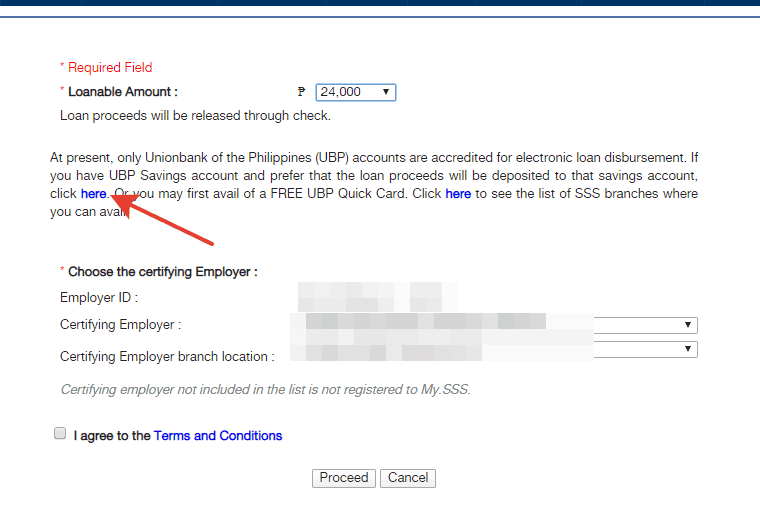

Kasi meron na akong existing UnionBank savings account, dinagdag ko nalang ito sa aking SSS account (follow the arrow)…

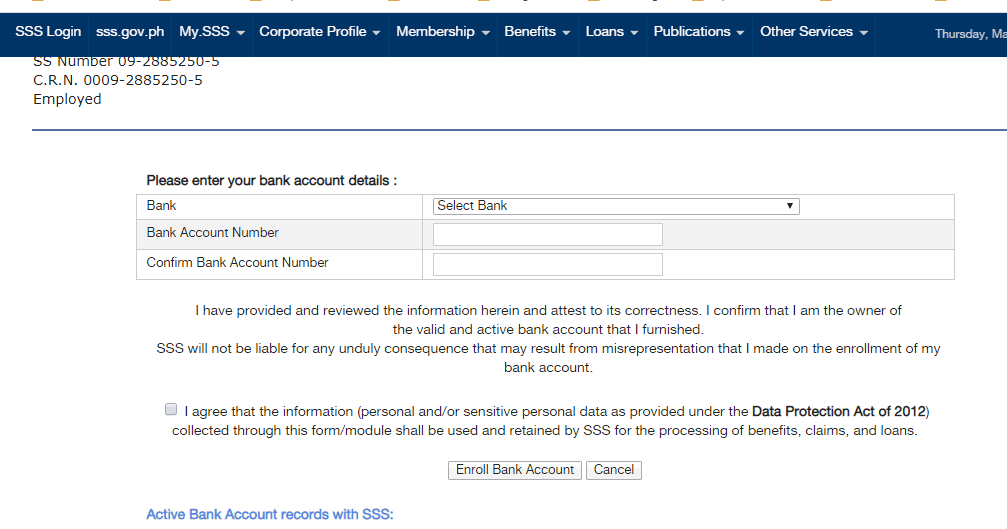

Ang screenshot na nasa itaas, ito yung bank enrollment form… be careful with the details, lalo na sa bank account number…

Bumalik ako ulit doon sa salary loan application form… See arrows!

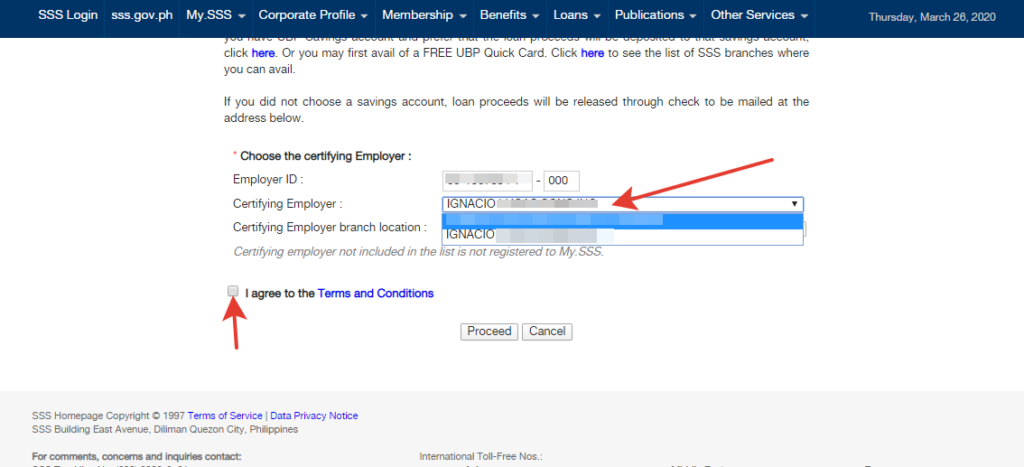

Ngayon, kailangan kung i-indicate yung current certifying employer… o yung present employer ko.

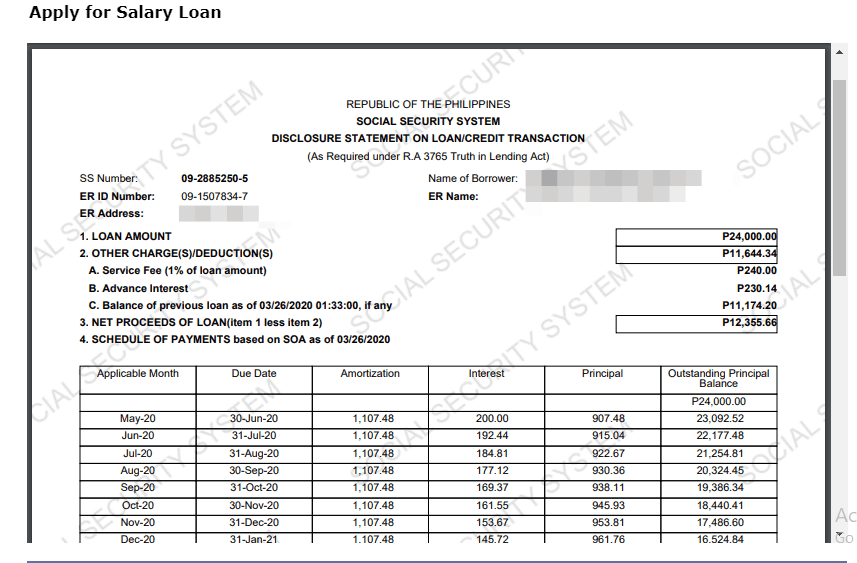

So, ito po yung disclosure statement ng SSS sa aking loan transaction… Makikita ko dito kung ilan na lang ang matatanggap ko na pera… deductions, pati yung amortizations schedule…

So, pagkatapos kung nag-apply, nag-inform kaagad ako sa aking employer, para ma-certify din nila kaagad ang aking loan application. Take note na may expirty ang loan application, so as soon as possible inform your employer na nag-apply kayo ng SSS Salary loan online…

I will show you the screenshot of your employer can certify your loan application… it will be done on their employer online SSS account too! Madali lang din…

Hindi pa po kayo qualified sa SSS Salary loan? Pwede niyong ma-try ang mga online loans ngayon o tinatawag nating OLA… mataas ang interest, pero okay na rin sa panahon na gipit tayo at wala nang ibang options o mautangan… besides, safe ito dahil no need ka na umalis ng bahay!

Bisitahin ngayon ang aming official online loans recommendation page https://pinoymoneys.com/pinoy-utang/

Want to make money online? Follow my series of tutorials on how to become a professional website designer without learning how to code…

Or try some micro jobs online like Remotasks…

Screenshots/image credits: sss.gov.ph

Official website address / create an account here: https://www.sss.gov.ph/

First loan 0% fees 97% recommended Repayment: Up to 30 days Age: 21-70 years old Up to P25,000 Best Choice |

Interest Rate 0% at first loan 98% recommended Repayment: Up to 30 days Age: 20-65 years old Up to P20,000 Super Fast |

Waiting Time Instant Approval 95% recommended Repayment: Up to 180 days Age: 21-70 years old Up to P20,000 Best Loan |

Sana ung apps ng sss sana may option doon like calamity loan..para di na kami mahirapan.

E-clarify ko lang sir, hindi po ito app, mag sign po kayo directly sa website nila… sana nga din po, kaso sa akin, wala pang options for calamity loan…