Suppose you are looking for a bank partner to help you with buying or building your dream house. For renovating or refinance. Then Security Bank Home Loan is what you need.

Security Bank knows the feeling of having a home you can call your own and even making your DREAM home a reality! That is why they created this loan product where application and approval are fast, and loan term and interest rate are fair and affordable.

In this article, we will tell you all you need to know about Security Bank Home Loan, such as their loan feature, how to be eligible, the steps for applying, requirements and repayments, and so much more.

We also provided some tips on how to get approved if you want to apply for a home loan. Make sure to read all the way to know what these tips are. It can surely help you.

Security Bank Home Loan Feature

Here at Security Bank Home Loan, you can loan up to 80% of your desired property!

Suppose you will take a New House & Lot, Townhouse, Duplex, or Condominium. You can loan up to 80% of appraised value.

If you take a Second Home/ Investment Use or a Vacant Lot loan, you can loan 70% of appraised value.

Security Bank Home Loan has a loan term minimum of 1 year and a maximum of up to 25 years. There are different maximum loan terms, depends on where you would use it.

If you will avail of a House and Lot loan, the maximum loan term is 25 years. For Townhouse or Duplex, the maximum loan term is 20 years, and for a Residential Vacant Lot or a Condominium Unit, the maximum loan term is 15 years.

The interest rate here at Security Bank Home Loan is low and affordable. With an interest rate starting at 6.25% fixed for 1-3 years. You can now enjoy living in your own home without the burden of paying high monthly payments.

When you choose a loan term higher than 1-3 years, the interest rate will change. For example, if you select a five (5) years loan term, the interest rate for that is 6.75%, and for a ten (10) years loan term, the interest rate would be 7.75%.

Note: Your interest rate’s final and confirmed information will depend on your loan amount and loan term upon loan approval.

Approval time here at Security Bank for your loan application only takes five (5) days. That’s fast! No need to wait for a week.

How to be eligible for Security Bank Home Loan

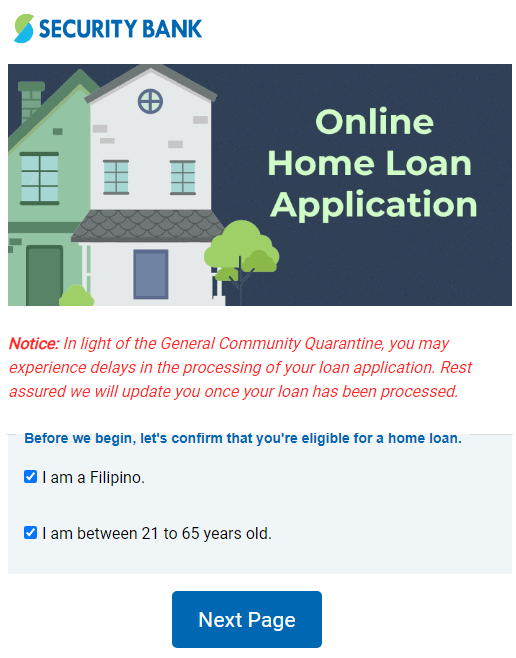

To qualify for Security Bank Home Loan, you should meet these qualifications listed below.

- Your age must be at least 21 years old but not more than 65 years old.

- You must be earning a combined monthly income of P50,000.00.

FOR EMPLOYED

- Must be continuously employed for at least two (2) years.

FOR SELF-EMPLOYED

- Your business must be legitimate and profitable for the last three (3) years.

Another way to find out if you are qualified for Security Bank Home Loan is to try their Home Loan Pre-Approval Quiz. If you want to try it, you can click here.

How to apply for Security Bank Home Loan

There are three (2) easy ways of applying for a Security Bank Home Loan. You can apply through

- Accredited Developer

- Online

- By going to their branches

- ACCREDITED DEVELOPER

- ONLINE

Applying online is the most convenient since we are now in a digital age where we can almost do everything through our phone, from shopping to ordering food, and now, even banking.

Banks like Security Bank take their service up to date and make it convenient for us.

That is why they have created an online application. You don’t need to go out and stand in long lines while risking your life with Covid-19 still roaming around looking for a victim. Now you can apply at the comfort of your home, safe and sound.

But since this is online, you need to prepare your gadget and make sure that you have a stable connection to avoid interruption during the loan process.

If you are interested and want to apply online, you can click here.

- GOING TO THEIR BRANCHES

If you have a lot of time and prefer these old ways by going to their branches, you can do so.

If you choose to apply by going to their branches, make sure you follow safety protocols like wearing a mask and face shield. Also, make sure you have a strong immune system to avoid the risk of getting the virus.

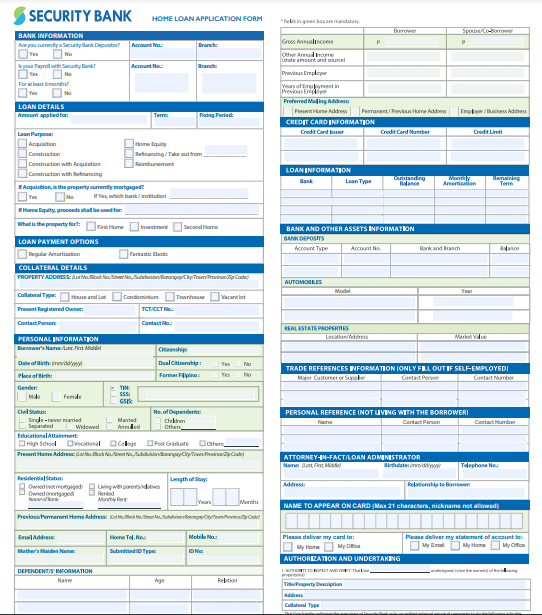

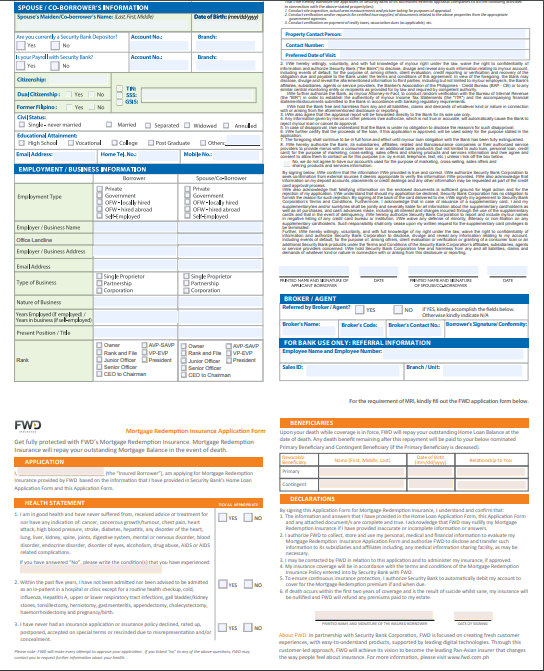

When applying at their branches, you need to download this document first and fill it up before going to their branches.

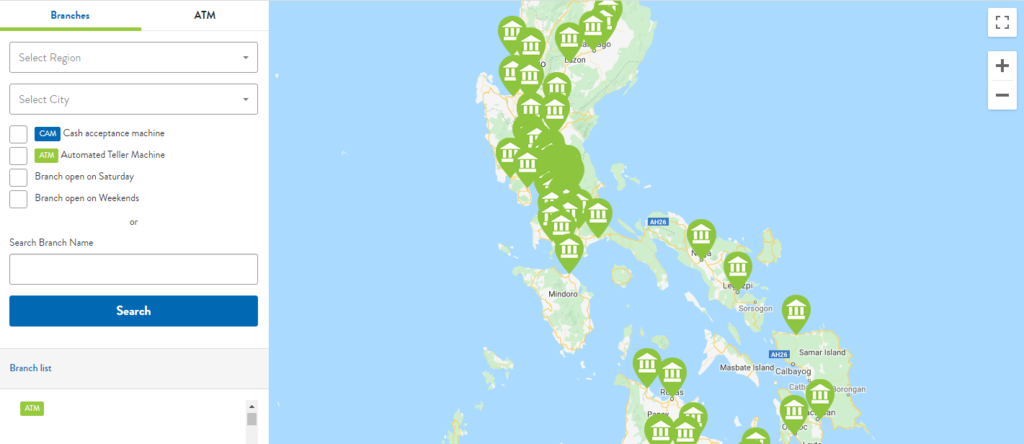

Security Bank can give you the service you need wherever you are in the Philippines, with their branches available nationwide. If you want to know the Security Bank branch near your place, you can check it here.

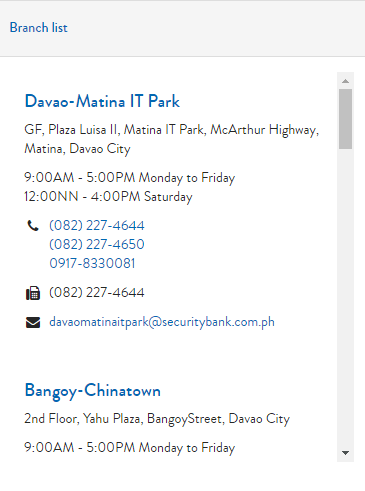

Pieces of information such as branch address, map, working hours, working days, email, and contact number are all provided.

Here is an example of how to find a branch near your place.

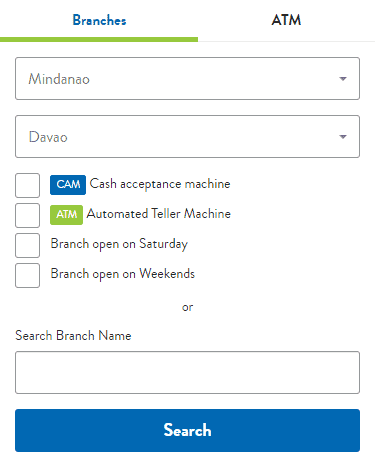

On the left side, enter your Region and your City. Here, for example, I will select Mindanao as the Region and Davao as the City.

After you click enter, Security Bank will show all available Security Bank branches in the selected area on the map.

And on the left side, you can see the list available with their important details, such as their contact number, email, working hours, and days.

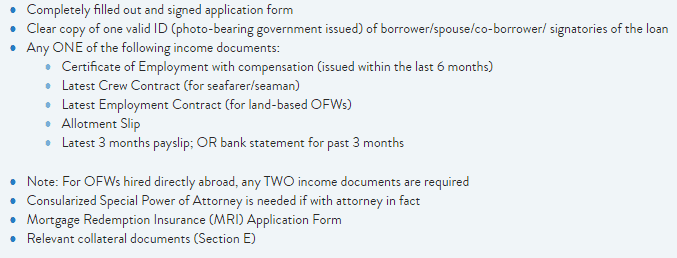

Security Bank Home Loan Requirements

Well, of course, your loan application wouldn’t complete without this list of requirements. If you want to avail of Security Bank Home Loan, you should present and prepare the following.

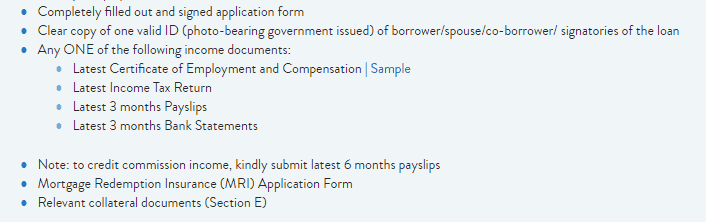

- FOR LOCALLY-EMPLOYED BORROWERS

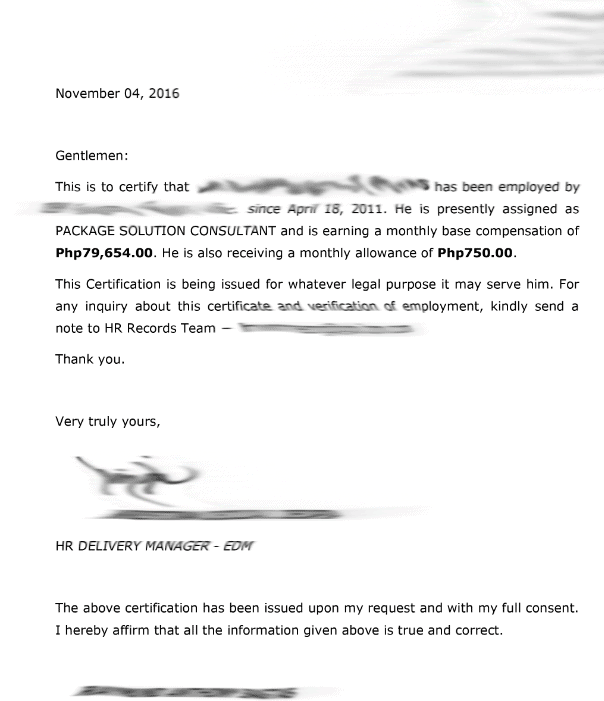

Here is an example of the Latest Certificate of Employment and Compensation.

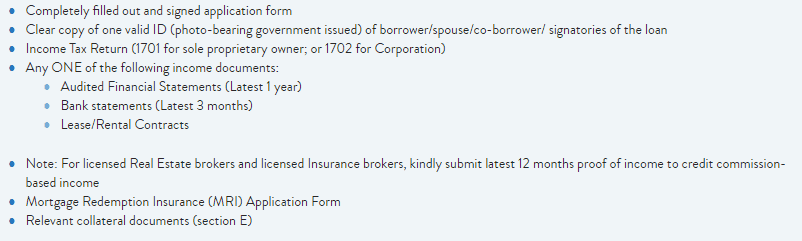

- FOR SELF-EMPLOYED BORROWERS

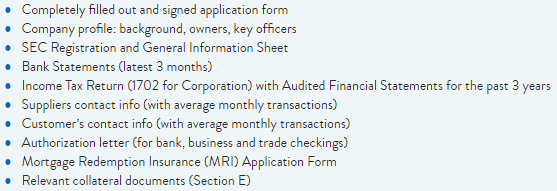

- FOR CORPORATE BORROWERS

- FOR OFW BORROWERS

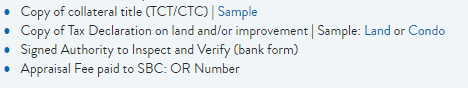

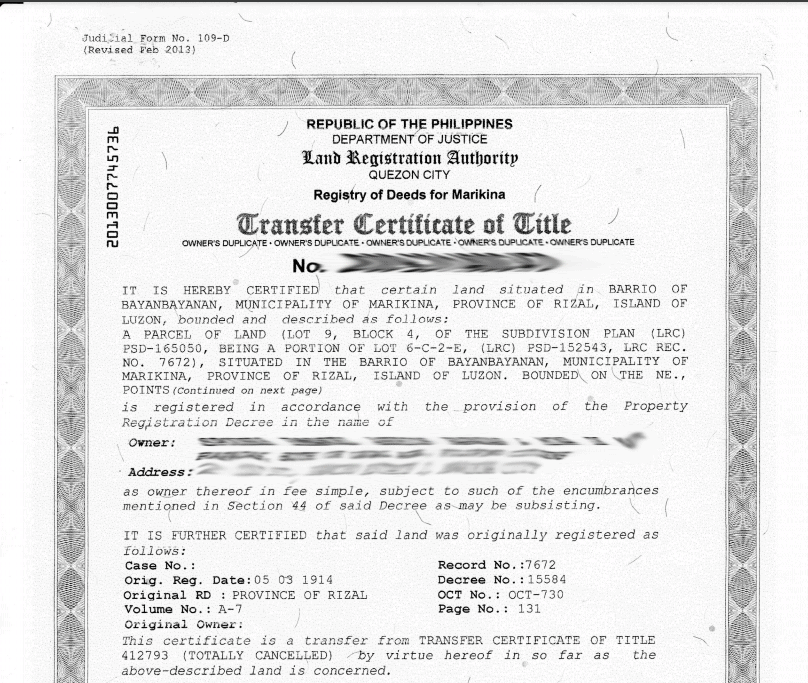

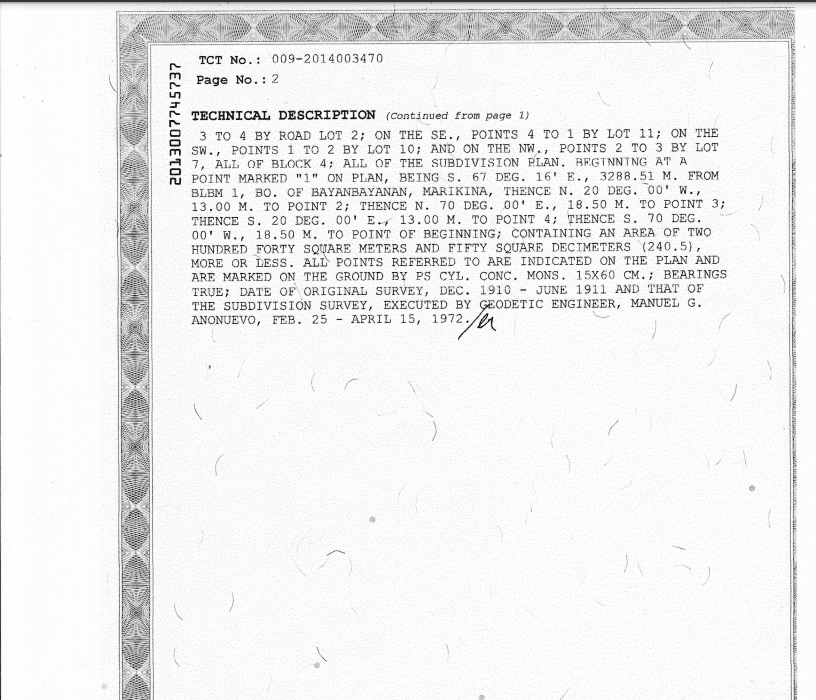

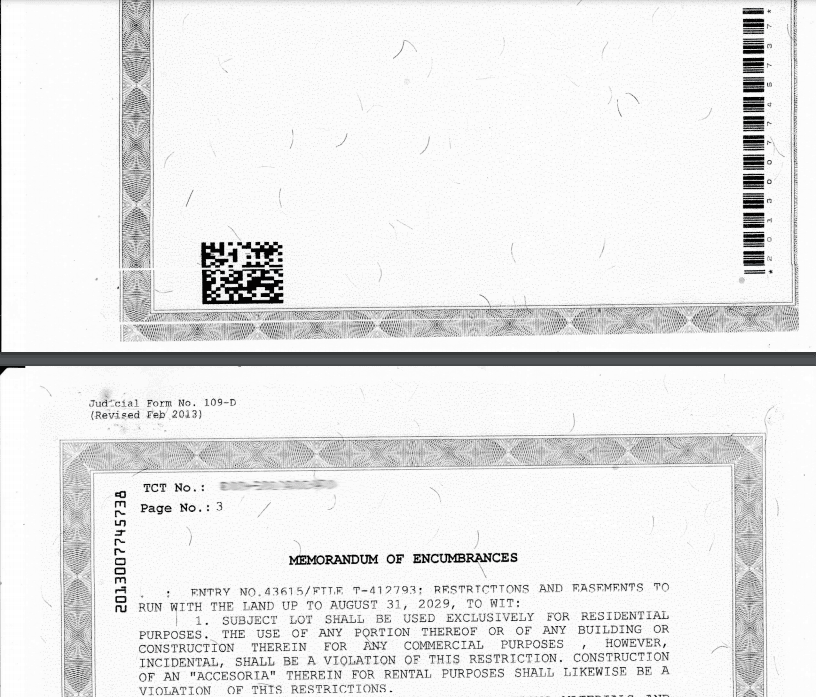

- COLLATERAL DOCUMENTS REQUIREMENTS

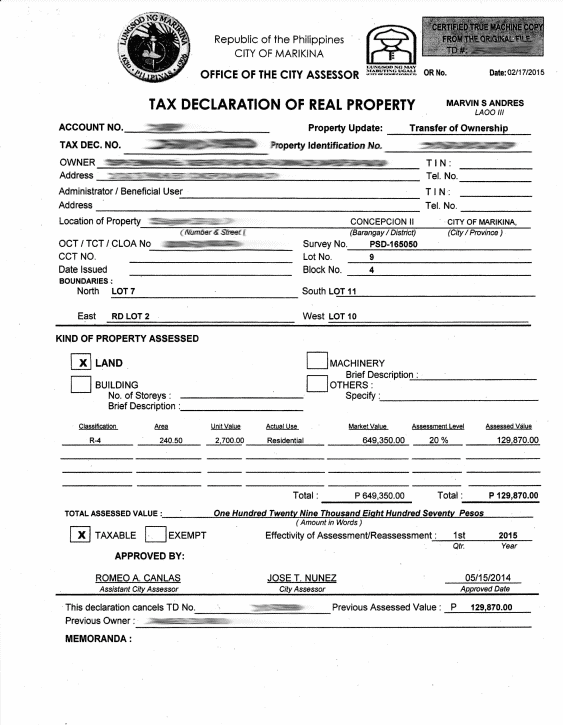

Here is an example of a copy of the collateral title (TCT/CTC)

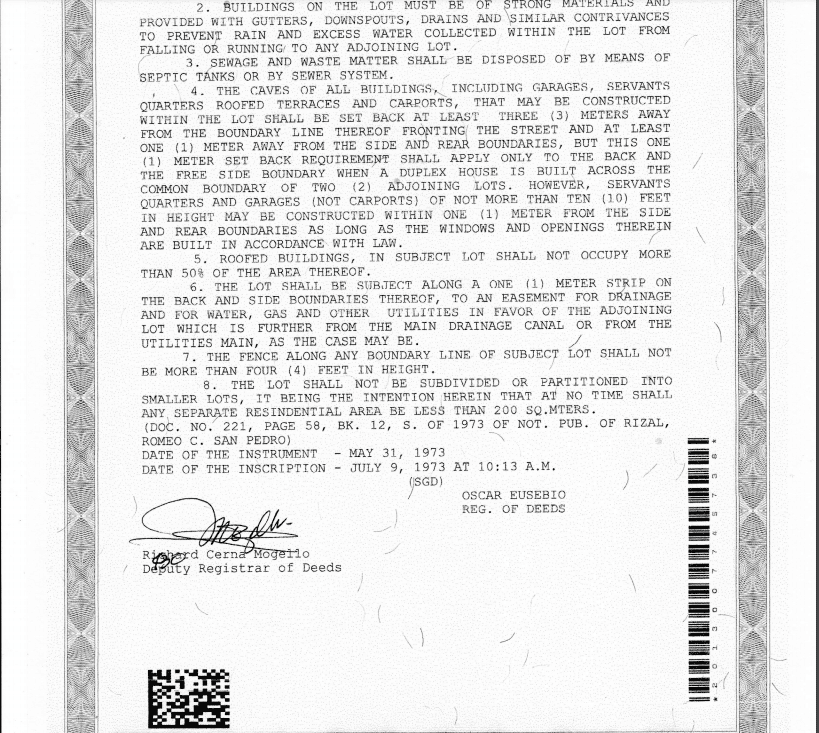

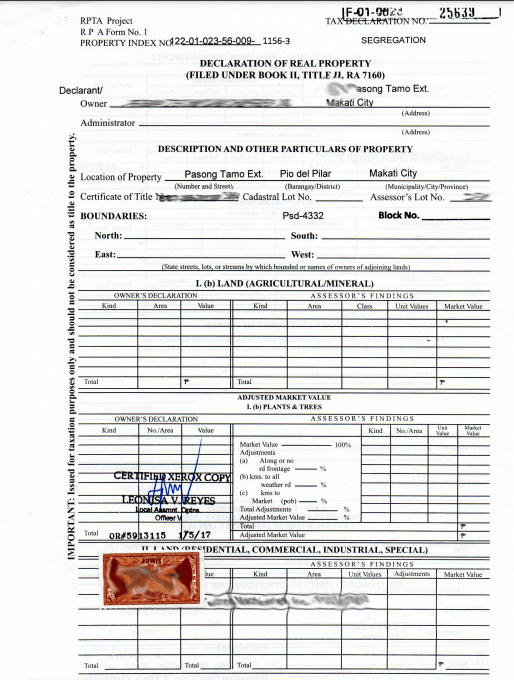

Here is an example copy of Tax Declaration on Land and/or improvement for Land

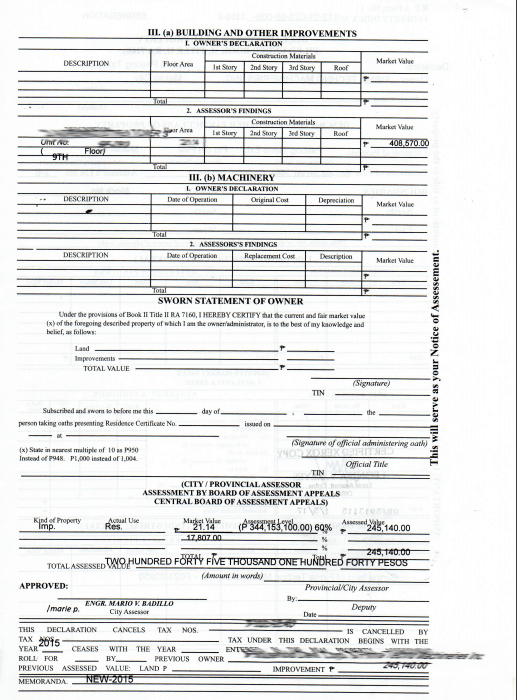

Here is an example copy of Tax Declaration on Land and/or improvement for a Condo

- ACQUISITION FORM ACCREDITED DEVELOPER

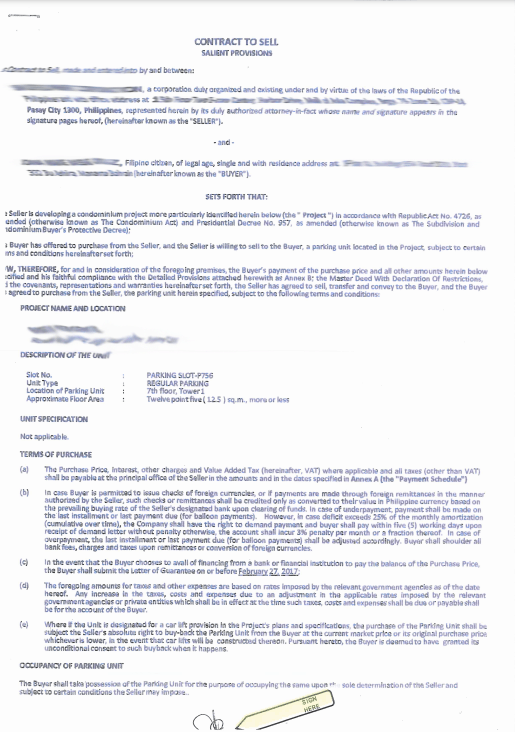

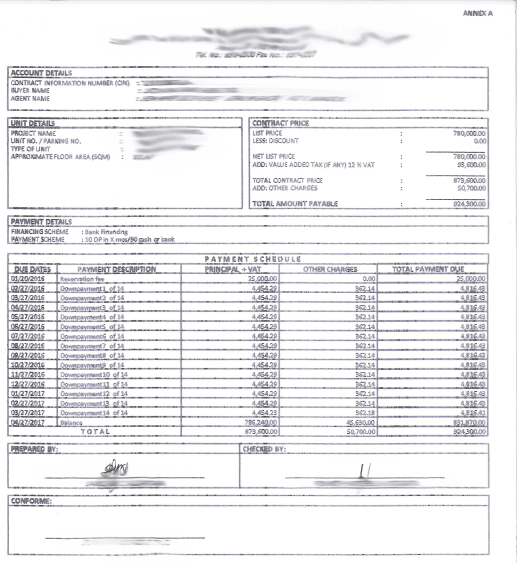

Here is an example of a Contract to Sell or Reservation Agreement

- HOME CONSTRUCTION or RESERVATION

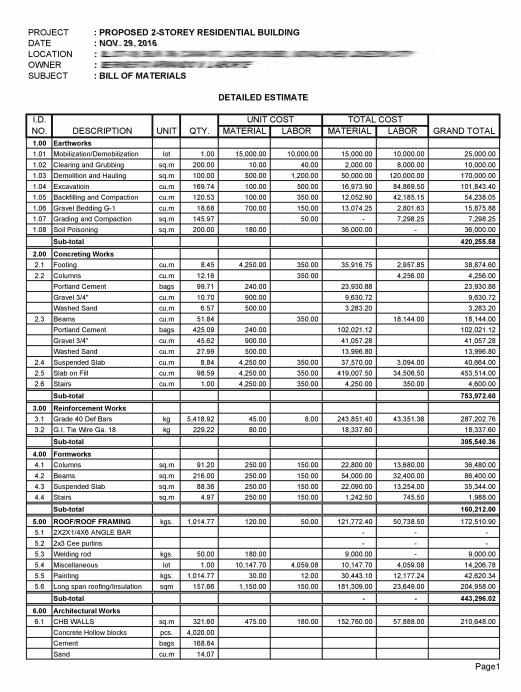

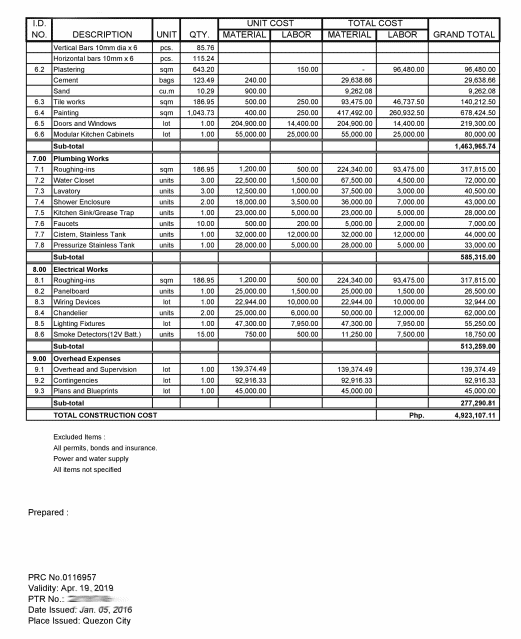

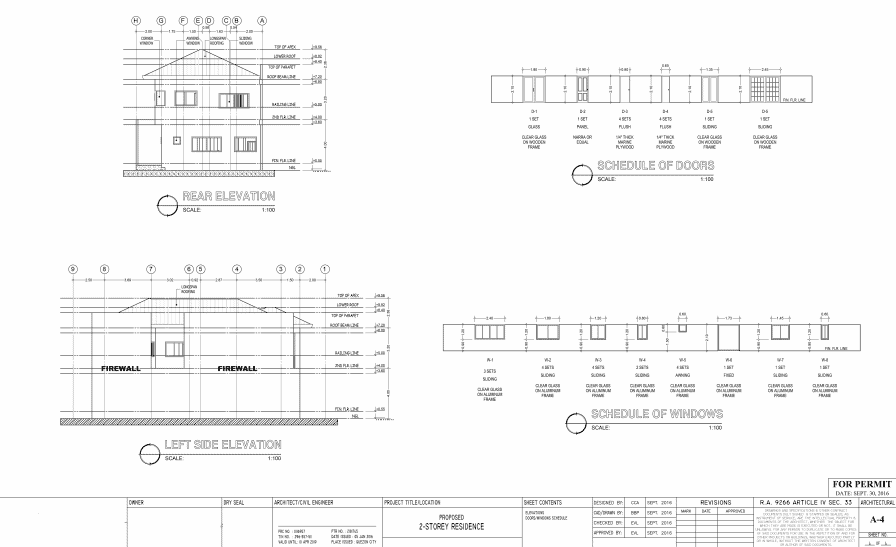

Here is an example of Bill of Materials and Estimates of Construction and Labor Cost

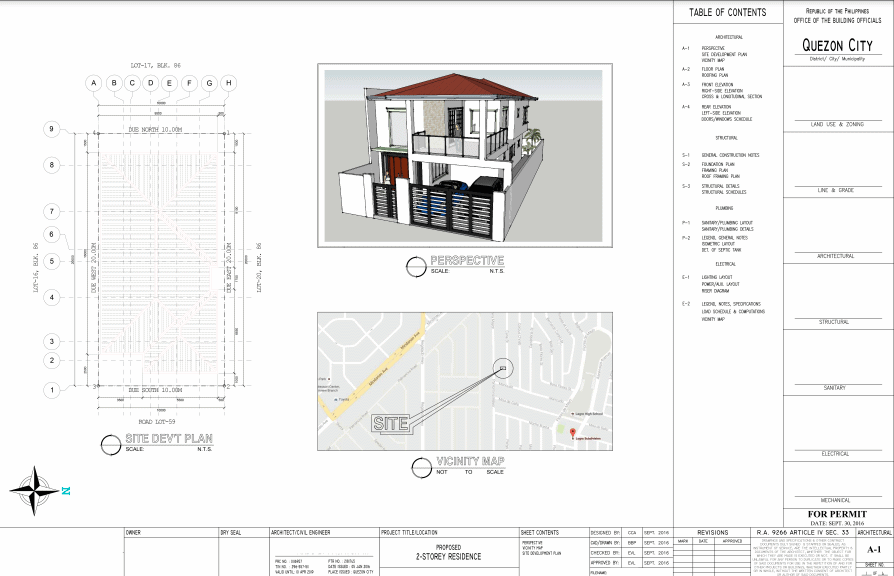

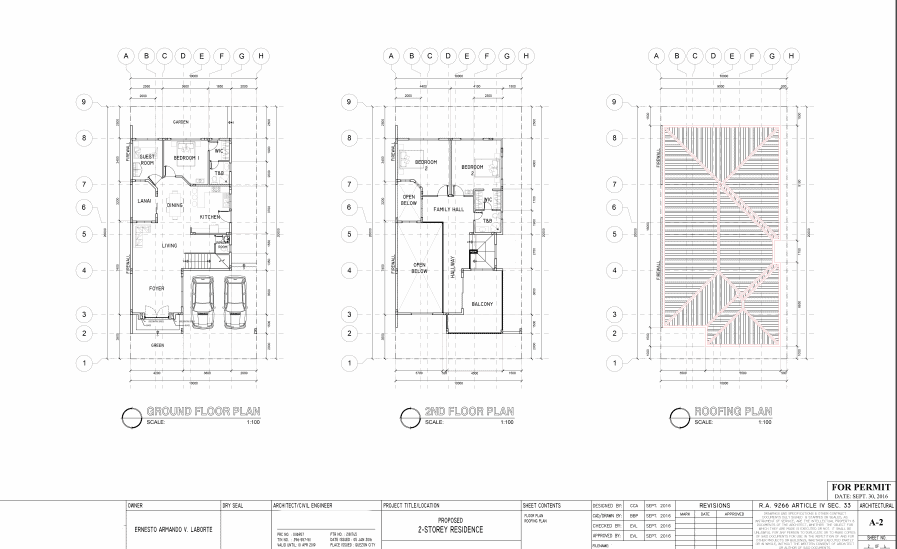

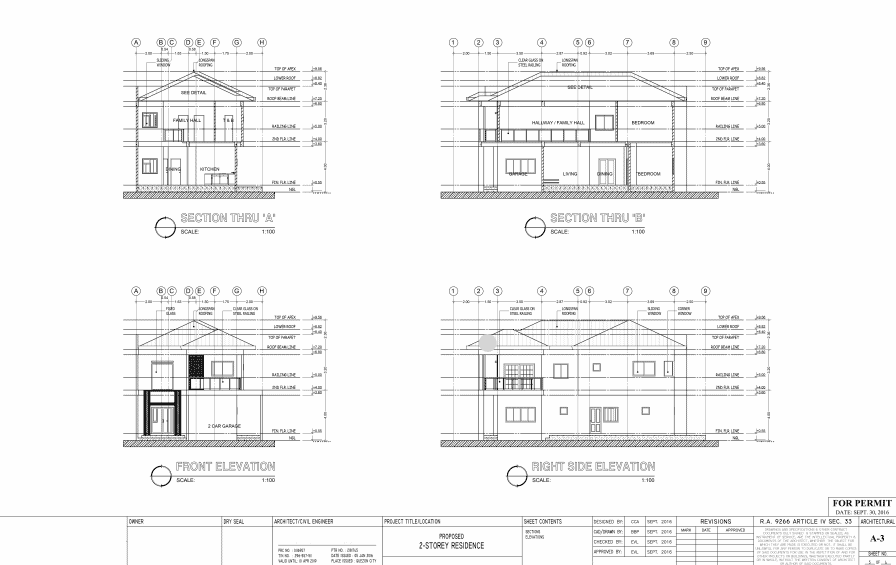

Here is an example of Floor and Building Plan and Building Specifications

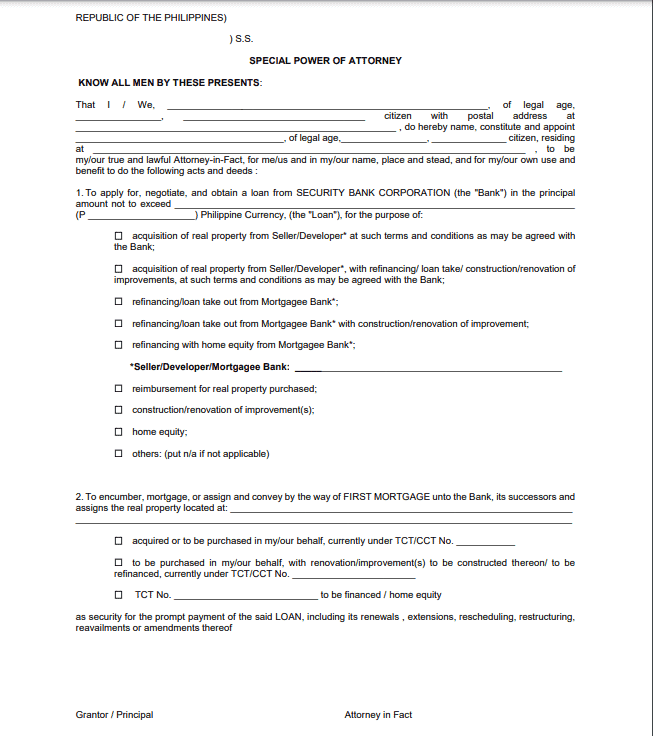

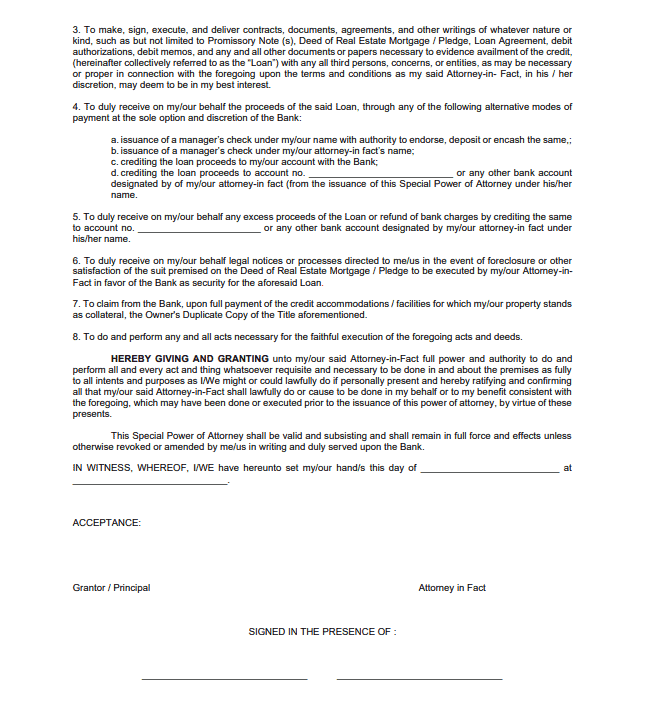

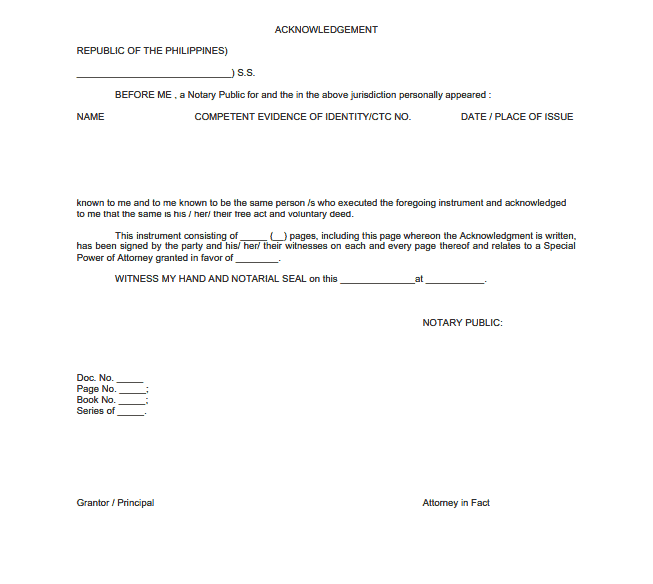

You also need to prepare a Special Power of Attorney (SPA) document.

If you apply online, you can send these requirements via email.

If you apply on their branches, make sure you prepare all the needed requirements for your loan application’s faster transaction.

How to Pay your Security Bank Home Loan

You can pay your loan via Auto Debit Arrangement or ADA. Here, your payment will be automatically deducted from your Security Bank account.

To do this, you need to open an account first in any Security Bank branch. During loan application for a home loan, enroll the account as your settlement account for your housing loan upon booking.

Security Bank will collect your equal monthly amortization of principal and interest one (1) month after loan release. And the following amortization due date shall follow the date of the first amortization.

What Other Say About Security Bank Home Loan Service

Are you an OFW who wants to avail of this kind of loan service? Well, you can! Security Bank Home Loan makes it available for you.

Security Bank Home Loan is a great deal for those who want to build their dream home or renovate old houses into new and fit their dream house design.

Tips on How to Get Approved for Security Bank Home Loan

I know you are all excited about this since applying for a home loan is not easy, unlike getting a personal loan, which is practically easier.

To have an idea of how to get approved for a Security Bank Home Loan, we would like to share these tips. These are tips given by Security Bank itself, and you can read them on their website also. But if you are here already, then just continue reading. LOL

TIP # 1 EVALUATE YOUR FINANCIAL CAPACITY

This means that you should know the limit of your income. Calculate first if your assets or monthly income can cover all the expenses if you apply for a home loan. One of the best ways to do this is by talking with your potential lender. They can help you evaluate your financial capacity.

TIP # 2 CLEAN UP YOUR CREDIT HISTORY

One of the most important that you should always keep in mind, especially if you have considered taking a loan. Others tend to ignore this cause they think that past records would be forgotten, or the bank where they are taking a loan wouldn’t know that they have a bad credit history from other banks or lending platforms.

That mindset is a big mistake. Banks and other lending platforms share information and the history of non-paying borrowers. This only shows that your credit history is like a smoke that you can’t keep. It’s not a secret. Banks share this important information with other lenders cause it’s a big red flag for them.

But it’s not too late (for those who have a bad credit history), and you can still change that. How? Clean up your credit history and make it good to perfect! Pay on time, pay off unpaid loans and get a payment certificate from the lending institution, and eliminate credit card balances.

TIP # 3 CREATE STABILITY

Be financially stable. Maintain stable cash flow and avoid getting new and big debt.

Quitting a job to change on becoming a self-employed person during the loan process is a big red flag for lenders. But that doesn’t mean that you cant do that. This only means that if you plan to be a self-employed person, do it before (2-3 years) getting a home loan and making sure that your business has a stable income source.

Also, keep in mind that to avoid major purchases while you are still in the process for your home loan application, like getting a new car or funding big expenses like grand weddings or parties.

TIP # 4 PREPARE ALL REQUIRED DOCUMENTS

Before applying for a loan, make sure that you have prepared all of this. Especially that one thing that can prove who you are, your up-to-date Valid ID, and make sure that the address on all your IDs is all correct.

Also, keep in mind that applying for a home loan requires a lot of requirements/ documents. Make sure that you compile them before you start your Security Bank Home Loan application.

Those are some of the tips that we would like to share. If you wish to know more information, click here and read more helpful tips for a bigger chance of approval.

Taking a home loan is not that easy. It takes a lot of time, patience, and money, But it is an excellent investment. If you have all that it takes to qualify for Security Bank Home Loan, then you should go for it.

If you plan on buying a house, you also need to buy stuff to fill it in. While a home loan can help you avail your dream house, a personal loan can help you buy the things you need to fill it in.

These banks offer personal loans with low add-on interest rates and long loan terms. You can use this to buy what you need to beautify your dream house.

- Security Bank Personal Loan offers a monthly add-on rate of 1.39% – 1.69% percent per month.

- CIMB Bank Personal Loan offers 1.12% up to 1.95% monthly add-on interest rate

- PS Bank Flexi Personal Loan offers a 2.5% per month for revolving loans and a 1.75% add-on interest rate per month for those who will choose Fixed Term Loan.

- Maybank Personal Loan offers an add-on rate of 1.3% per month.

Are you looking for a loan for an emergency? You can also check this out. This list of online lendings offers fast cash, perfect for emergency needs.

For more information and queries, you can contact Security Bank at the following.

- Costumer Service Hotline: +632 8887-9188/ 1-800-1-888-1250

- Email: customercare@securitybank.com.ph

Source: Security Bank Home Loan

First loan 0% fees 97% recommended Repayment: Up to 30 days Age: 21-70 years old Up to P25,000 Best Choice |

Interest Rate 0% at first loan 98% recommended Repayment: Up to 30 days Age: 20-65 years old Up to P20,000 Super Fast |

Waiting Time Instant Approval 95% recommended Repayment: Up to 180 days Age: 21-70 years old Up to P20,000 Best Loan |

think twice for this lending company..beware its a super loan shark.you are paying more than what you have borrowed from them.