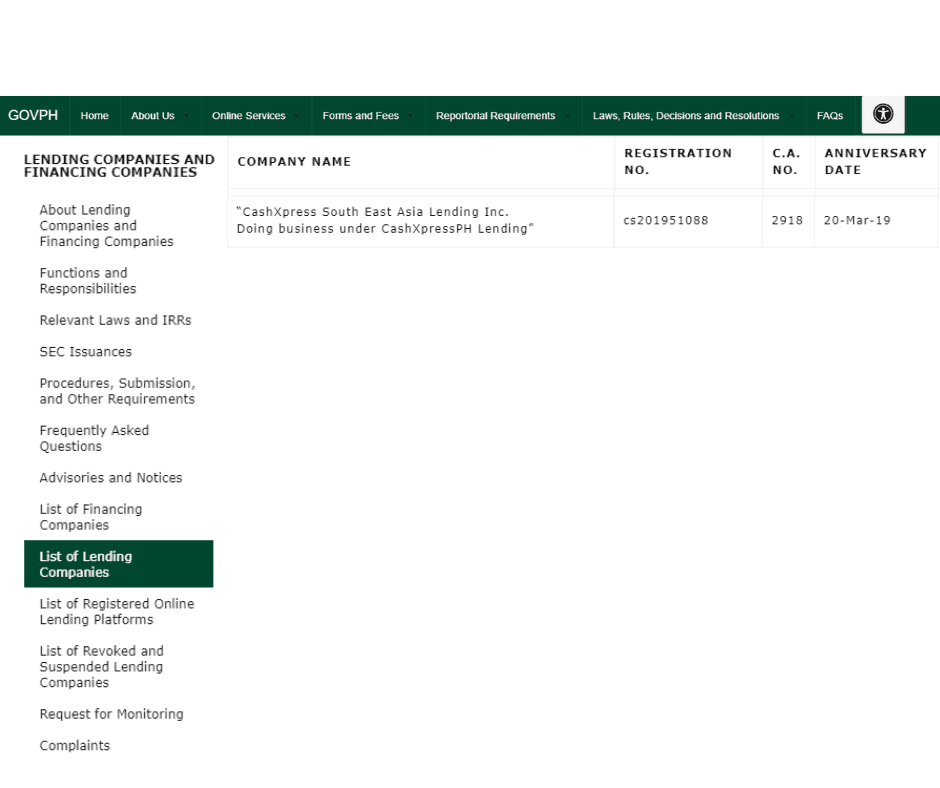

Company Name: CashXpress South East Asia Lending Inc. (Doing business under CashXpressPH Lending)

CashXpress Philippines is an online lending platform in the Philippines that provides easy and fast cash to those who need financial assistance for emergencies.

CashXpess Philippines is an online legal lending and is operating under the law of the Philippines. If you will search at sec.gov.ph website, on their list of registered lending. You can see CashXpress Philippines there with a Sec Registration no. CS201951088 and C.A. no. of 2918.

CashXpress Philippines started its loan service operation on March 20, 2019, and is still operating today, even amidst the pandemic.

CashXpress Philippines Contact Information

Address: Avida CiryFlex, 7th Ave. Cor. Lane T, North Bonifacio, Bonifacio Global City, Taguig

Phone Number: +632 7933-2360

Email: info@cashxpress.ph

Working Days: They are available Mon. – Fri. 10:00 AM – 8:00 PM

CashXpress Philippines Loan Feature

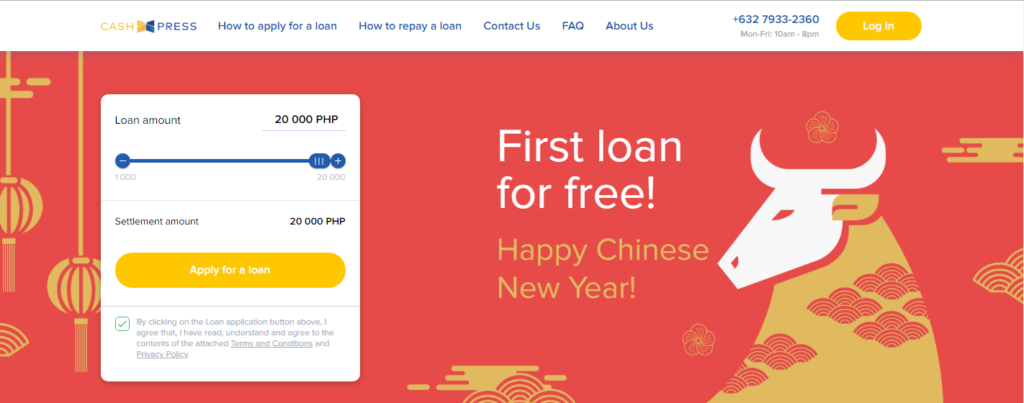

CashXpress Philippines minimum-maximum loan amount

Here at Cashxpress Philippines, you can take a loan.

- Minimum – P1,000.00

- Maximum – P20,000.00

However, they have a loan limit for all first-time borrowers. You can only take

- Minimum – P1,000.00

- Maximum – P 10,000.00

Even if they have a loan limit for all first-time borrowers, but rest assured that CashXpress will increase your credit limit. You only need to maintain a good to perfect credit history record by always paying on time.

CashXpress Philippines Loan Term

CashXpress Philippines has a loan term of

- Minimum – 7 days

- Maximum – 30 days

CashXpress also offers a loan extension. So if you need more time to settle your payment, you can request CashXpress to extend your due.

You can extend your due three (3) days before or even on the day of your due. You can extend with the same period you took your loan. For example, if you took a loan with a tenor of 15 days, you can request to extend for an additional 15 days.

To avail of this offer, you need to pay first the minimum amount due, and you can pay the rest on the extended due date. But, take note that this offer has fees which CashXpress will state on the process.

You can call, email, or chat CashXpress so that they can assist you with your loan extension request, or you can follow these easy steps.

1. Log-in to your account

2. Click EXTEND LOAN button

3. Select the number of days you want to extend your loan due and check the MINIMUM PAYMENT required.

4. Click PAY MINIMUM AMOUNT to activate your loan due extension.

Reminder: To activate your loan extension request, you should pay the minimum amount on or before 6 PM of your due date.

Tip: To be safe, extend and pay the minimum amount due days before your due date. In case of errors, you still have time to work with it or get assisted before your due ends (where you need to pay late payment fees).

CashXpress Philippines Interest Rate

CashXpress Philippines offers a low-interest rate compare to other online lendings. On the sec.gov.ph website, you can see that CashXpress has an interest rate of 1% – 2.3% per month.

However, the final information on your interest rate will depend on the approved loan amount and tenor.

CashXpress also provided a calculator on their website that you can use to determine or to get the calculation of your loan.

And wait, there’s more! If it is your first time taking a loan here in CashXpress, well, here’s good news for you.

CashXpress offers the first loan for FREE! That means 0% interest on your first loan! Sounds good, right?

How to be Eligible for CashXpress Philippines

To be eligible for the CashXpress loan service, you should meet these qualifications listed below.

- You must be a Filipino citizen currently living in the Philippines.

- Your age must be at least 21 years old and not older than 50 years old.

- You must be employed or self-employed with a stable income source.

What are CashXpress Philippines Loan Requirements

Here is what you need to prepare and present if you want to avail CashXpress loan service.

- 1 Valid ID

- Bank account

Here is the list of Valid IDs that CashXpress will accept

- TIN ID (TAX ID)

- SSS

- GSIS

- UMID

How to Apply for CashXpress Philippines Loan

You don’t need to download an app if you want to apply for CashXpress loan. You only need to go to their website and click APPLY FOR A LOAN to start your loan application process. It only takes 5 – 30 minutes!

After that, you need to Register. You need to create your profile and fill out the application form.

Note: Provide all the information honestly and always check for errors and typos to avoid future problems.

Next, you will get verified. CashXpress will call you to finish the loan process and tell you the terms and conditions of their loan service. While waiting for the call, you should not let your phone unattended for CaxhXpress will call anytime. It would be a waste if you can’t accept their call.

After the call, you need to wait for minutes to know your loan application decision.

When and How can you Get the Money After Approval

If your loan application got approved, CashXpress would send you an SMS, Email or they will call you to update your status and send you the contract.

After that, your loan proceeds will be sent directly to your bank account, and your loan amount should be reflected within minutes up to 24 hours, depends on your bank.

If you haven’t received your money and if you think you have waited long enough, do not hesitate to contact CashXpress. They will be happy to assist you.

How and Where to pay CashXpress Philippines

Information about your due is included in your contract, CashXpress sent you during loan approval, or you can check it at your CashXpress account by clicking HISTORY.

You can pay at different channels partnered with CashXpress. To see the list of their partnered payment channels, just log in to your account.

To pay, just click PAY NOW and select your preferred payment method. CashXpress will provide payment instructions to help you every step of the way.

What do other people say about their service

These are some of the reviews CashXpress Philippines provided for those who have tried their service.

Since CashXpress Philippines is a new lending platform, you can’t find much feedback about them yet. If you have tried their service, please don’t hesitate to leave your review in the comment section below. It could be a great help for others looking for information about CashXpress’s performance and service.

Loan Alternatives

Aside from CashXpress, other online lendings also offer fast cash. They also only require a Valid ID, and it is easy to qualify for a loan. These are the following.

- Robocash Online Loans – Offers loan for FREE for all first-time clients!

- Online Loans Pilipinas – Offers the first loan for free! 0% interest if you pay your first loan on time.

- KVIKU – You can loan a minimum amount of P1,000.00 and a maximum of P25,000.00

- MoneyCat – 100% online application, and you only need 1 Valid ID to apply!

- JuanHand – Get your cash in 5 mins.!

For more list of online lendings that offer quick cash, you can check it here.

If you are looking for a loan offer where you can loan higher amounts, you can try Banks Personal Loan as an alternative. The following banks offer high loanable amounts with low-interest rates and long terms. You can also check them out.

- Security Bank Personal Loan – You can loan a minimum amount of P30,000.00 and a maximum of P2,000,000.00 with a monthly add-on interest of 1.39% – 1.69%. They have a flexible loan term of 12 up to 36 months.

- CIMB Bank Personal Loan– You can loan a minimum amount of P30,000.00 and a maximum of P1,000,000.00 with a monthly add-on interest of 1.12% up to 1.95%. They have a loan term of 12 up to 60 months.

- PSBank Flexi Personal Loan- You can loan a minimum amount of P20,000.00 and a maximum of P250,000.00 with an interest rate of 2.5% for a revolving loan and 1.75% for a fixed loan. They have a loan term of 24 up to 36 months.

- HSBC Personal Loan- You can loan a minimum amount of P30,000.00 and a maximum of P500,000.00 with a monthly add-on interest of 0.65%. They have a loan term of 6 up to 36 months.

- Maybank Personal Loan- You can loan a minimum amount of P50,000 and a maximum of P1,000,000.00 with a monthly add-on interest rate of 1.3%. They have a loan term of 12 up to 36 months.

For more list of banks that offer personal loans, you can check it here.

Source: CashXpress Website

First loan 0% fees 97% recommended Repayment: Up to 30 days Age: 21-70 years old Up to P25,000 Best Choice |

Interest Rate 0% at first loan 98% recommended Repayment: Up to 30 days Age: 20-65 years old Up to P20,000 Super Fast |

Waiting Time Instant Approval 95% recommended Repayment: Up to 180 days Age: 21-70 years old Up to P20,000 Best Loan |

Pingback: Loan with ZERO Interest Using 1 Valid ID Only! - Legit Loan Finder

Pingback: UnaCash Quick Cash Loan App- Best Loan App Philippines 2021