Here in the Philippines, PBCom Personal Loan is one of the banks that offer low interest-rate.

So if you need cash to fund your child’s education and future, a memorable once in a lifetime dream wedding, or a dream vacation with family and friends. Whatever it is, PBCOM Personal Loan will give you what you need and help you achieve those dreams.

Are you interested in availing of their loan? Are you looking for information about their service? Then you are in the right place. Keep reading and keep scrolling to gather all the pieces of information you need to know.

PBCOM Personal Loan Feature

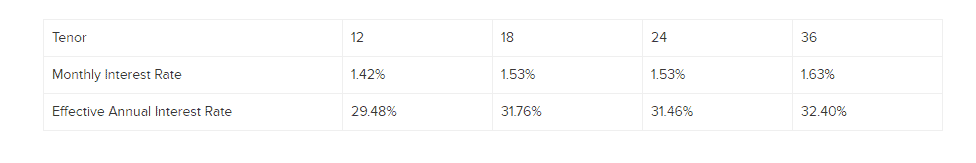

Here at PBCom Personal Loan, you can loan an amount with a minimum of P40,000.00 and a maximum of P1,000,000.00, and they offer flexible loan terms. You can choose between 12 – 36 months.

As we have said earlier in this article, PBCom offers a low monthly interest rate. For as low as 1.68% per month!

For those looking for cash to fund their business or fund something big with affordable payment terms, PBCom Personal Loan is definitely a great offer.

But if you are setting a loan limit for yourself and are looking for a lower minimum amount offer, then there’s another option. You can try CIMB Bank Personal Loan or HSBC Personal Loan. They offer a P30,000.00 minimum loan amount or PSBank Flexi Personal Loan, which offers a P20,000.00 minimum loan amount.

You can also see our bank list that offers personal loans with fair and flexible terms for more bank offers.

How to be eligible for PBCom Personal Loan

To be eligible or qualify for a loan, you should meet these qualifications listed below.

- You must be a Filipino or a foreign citizen currently living in the Philippines

- If you are a foreign citizen, you should present any of the following.

– Immigrant Certificate of Residency

– Documents as required by Executive Order 226

– Visa and Work permit

- You should have a locally-issued credit card issued 12 months prior with a credit limit of P30,000.00.

- If you are employed, your monthly income must reach P35,000.00, or your minimum gross annual income must reach P260,000.00.

- For self-employed, your business must be operating for almost three (3) years with a minimum gross annual income of P300,000.00 or at least reach P35,000.00 per month for self-employed individuals.

For those who don’t have an idea what gross annual income is. Gross annual income is the amount of income you earn in a year before taxes, and it comes from all sources, and it is not limited to the income you received in cash.

For example, you have a job with a stable income, yet you earn money from your property or service you give, you could also include that at your gross annual income.

How to know what your gross monthly income is? Here’s how you calculate that.

First, you multiply your hourly salary (if you are paid hourly) or your weekly salary (if you are paid weekly) by the number of hours you work per week, then the total of that will be multiplied by 52. And that is your gross annual income. If you want to know the monthly income, then just divide the total by 12.

Why is it important to know that? Because even though your monthly income can’t reach the required minimum amount, which is P35,000.00 but if your total gross annual income will reach the minimum amount of P260,000.00 for employed or P300,000.00 for self-employed. Then that means that you are qualified for a loan, and you are welcome to apply.

How to apply for PBCom Personal Loan

There are easy steps if you want to apply for PBCom Personal Loan.

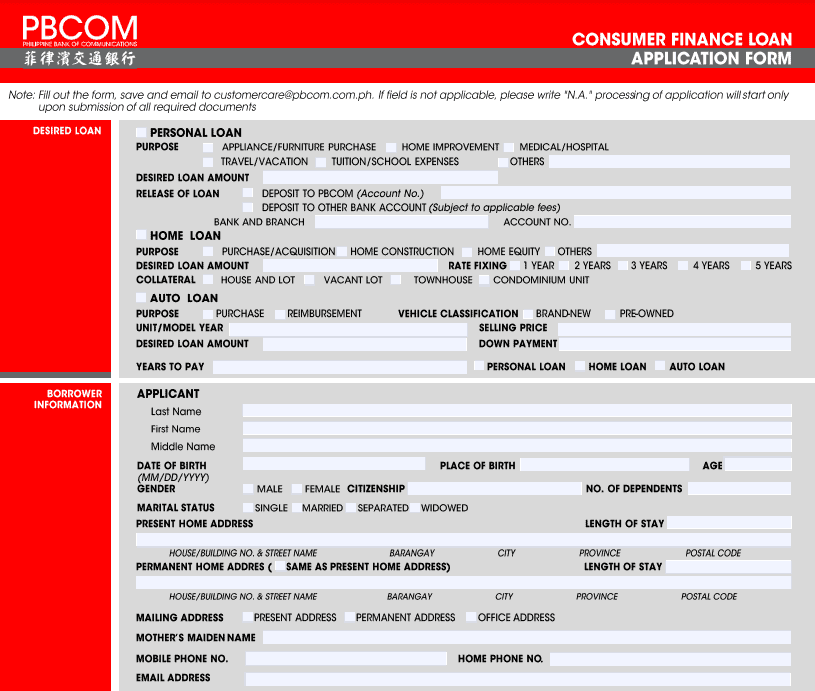

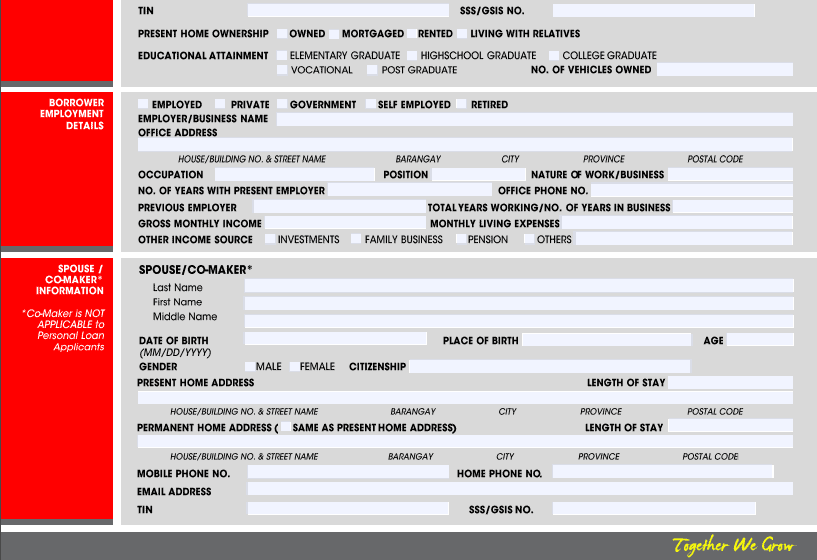

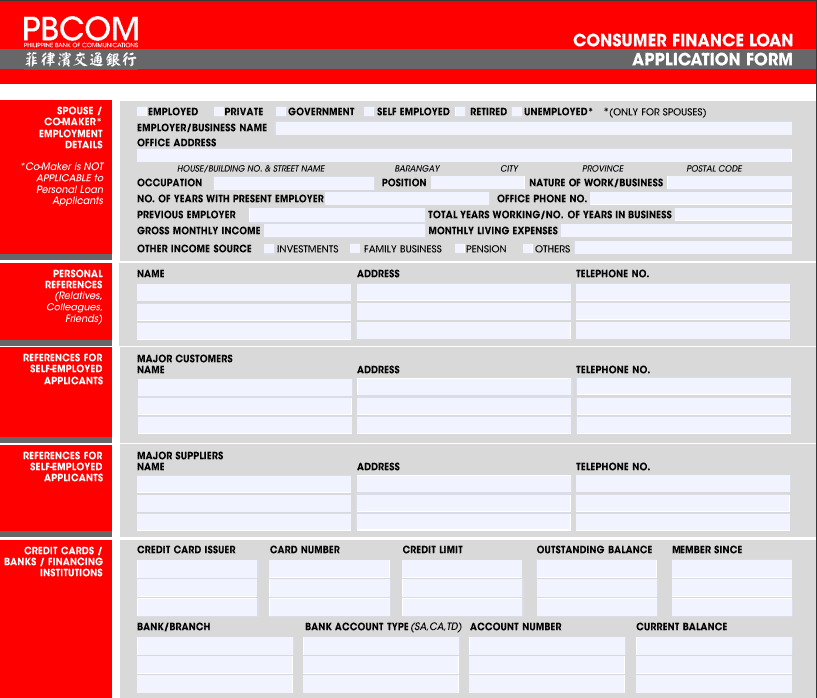

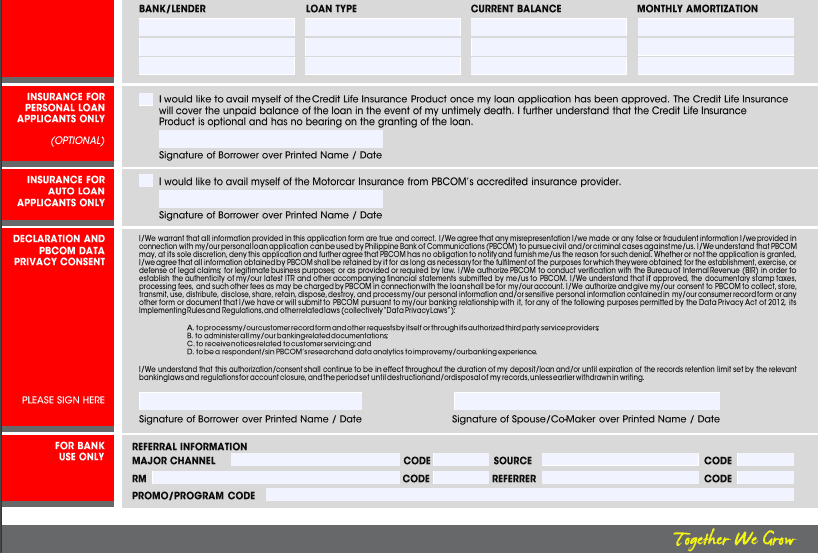

- First, You need to fill out the Personal Loan Application Form.

This PBCom Personal Loan application form is available online. And you can download it at the PBCom website. You can also click here for the form pdf file. Here is what it looks like after you download it.

You need to fill out the PBCom Personal Loan application first before you download it. Make sure you fill it out honestly and always check for errors to avoid future problems.

After you fill out and download the file, you can send it to their email, CustomerCare@pbcom.com.ph.

- Second, An email confirmation will be sent to your email.

It may take a while or not. Experience may differ from each other at these parts.

- Third, The Contact Center will call you within three (3) days from the day of your submission.

During these days, you should be attentive and don’t leave your mobile phone behind. Contact Center might call you anytime, and it would be a waste if you can’t answer them. Also, I know three (3) days of waiting is a bit long, so Patience is the key here.

Also, note that you should give your active and own mobile or telephone number when giving the contact number to avoid future problems.

PBCom Personal Loan Requirements

- Complete filled-out signed Application Form (Original)

- Latest two (2) months credit card statement.

- Photocopy of your credit card (front only)

- Proof of Income (You can choose either of the following)

– Latest Income Tax Return (ITR) (Photocopy only)

– Employer’s Certificate of Compensation Payment/Tax Withheld (BIR Form 2316)

– Latest three (3) months payslip

- If you are a foreigner but a local resident, you need to provide a copy of the following documents allowing your stay in the Philippines.

– VISA

– Alien Certificate of Registration

- Two (2) Valid IDs w/ photo and signature. (Photocopy only)

These are the accepted government-issued IDs

– Passport

– UMID

– SSS

– Driver’s License

– PRC

FOR SELF-EMPLOYED

- Complete filled-out signed Application Form (Original)

- Latest two (2) months credit card statement.

- Photocopy of your credit card (front only)

- Post-dated checks

- Latest Income Tax Return (ITR) (Photocopy only)

- Latest Audited Financial Statements (AFS)

- DTI/SEC Business Registration Certificate (Photocopy only)

- Two (2) Valid IDs w/ photo and signature. (Photocopy only)

These are the accepted government-issued IDs

– Passport

– UMID

– SSS

– Driver’s License

– PRC

PBCOM Personal Loan Fees and Charges

Processing Fee: P2,500.00 Deducted from loan proceeds or paid over the counter.

Documentary Stamp: P1.50 for every P200.00 of the loan amount or a fraction thereof

Returned Check Fee: P1,000.00 per check

Closure Handling Fee: P800.00 or 5% of the Total Outstanding Balance, whichever is higher

Manager’s Check: P50.00

PBCOM has a late payment fee of P500.00 or 3% of the installment amount due, whichever is higher. If you want to avoid unwanted payments, then be a responsible borrower and always pay on time. Also leaving a good credit history means a higher chance of approval so always pay on time.

For queries and for more information you can contact PBCom here: https://www.pbcom.com.ph/contact-us

If you are looking for PBCom branch near you, you can search it here.

Source: PBCom Personal Loan

First loan 0% fees 97% recommended Repayment: Up to 30 days Age: 21-70 years old Up to P25,000 Best Choice |

Interest Rate 0% at first loan 98% recommended Repayment: Up to 30 days Age: 20-65 years old Up to P20,000 Super Fast |

Waiting Time Instant Approval 95% recommended Repayment: Up to 180 days Age: 21-70 years old Up to P20,000 Best Loan |

Pingback: Maybank Personal Loan - 1 of the best and lowest interests in the Philippines! - Pinoy Moneys

Pingback: PSBank Flexi Personal Loan - 1st and only personal loan with revolving credit line and fixed term - Pinoy Moneys

Pingback: CIMB Bank Personal Loan- 100% Online Transaction in Just 10 Minutes and Get Approval as Fast as 24 hours! - Best loan offer! - Pinoy Moneys

Pingback: Online Loans Pilipinas - Best Offer - 0% Interest Rate for First-time Borrower! - Pinoy Moneys

Pingback: HSBC Personal Loan - As low as 0.65% monthly add-on interest rate per month! - Pinoy Moneys