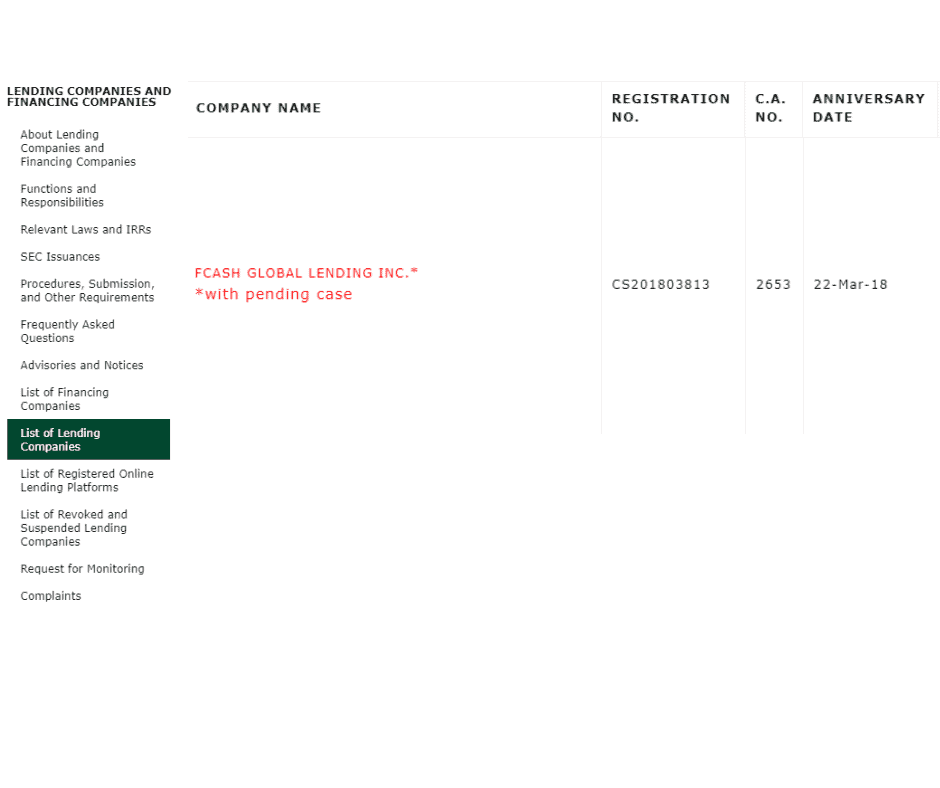

Company name: Fcash Global Lending INC.

Fast Cash Loans is an online lending platform in the Philippines that provides non-collateral, safe, convenient, transparent, and fast loan service.

Fast Cash is a legal online lending and operates under the Philippines’ law with an SEC Reg. no. CS201803813 and a CA no. of 2653

Fast Cash started its loan service on March 22, 2018, and is still operating as of today.

Note: From what you can see, Fast Cash has a pending case. If you want to avail of their loan service, we recommend searching for more information about them and think twice before proceeding with the loan.

Fast Cash Loans Contact Information

Address: Unit D NO. 41 12th street, Mariana, Quezon City, Second District NCR Philippines 1112

Email: cs@fcash.ph

Fast Cash Loans Feature

Fast Cash Loans Minimum-Maximum Loan Amount

Here at Fast Cash, you can loan

- Minimum amount: P2,000.00

- Maximum amount: P12,000.00

But, just like other online lending apps that offer a short-term loan, Fast Cash also has a credit limit for all first-time borrowers.

If you are a first-time borrower, Fast Cash Loans will only allow you to loan this amount.

- Minimum amount: P2,000.00

- Maximum amount: P4,000.00

Tip: If you are a first-time borrower, select a low amount at your first loan for a higher chance of approval.

Fast Cash Loans Term

Fast Cash has a loan term.

- Minimum: 3 months

- Maximum: 4 months

However, all first-time clients can’t avail of that loan term yet. Fast Cash Loans might only approve a seven (7) up to 14-day loan tenor if it is your first loan.

If you want to avail higher loan term, maintain good credit history with them, and rest assured Fast Cash will increase your available loan term.

Fast Cash Loans Interest Rate, Fees, and Charges

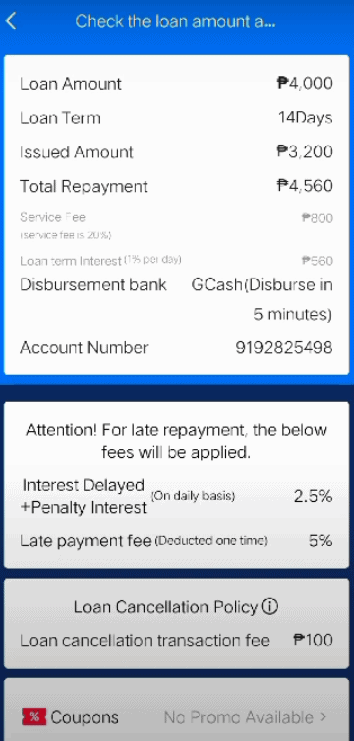

Fast Cash loans has an interest rate of 1% per day and an Annual Percentage Rate (APR) of 14% per year.

Relatively high, and it is the same with other online lendings. Almost all online lending that offers short-term and quick loans has a high-interest rate like that of Fast Cash.

Fast Cash loans have a service charge which will be deducted from your loan proceeds. That means you can’t get the exact amount of your loan, but you need to pay the whole amount with interest on your due date.

If you are a new borrower, Fast Cash will charge you.

- 20%

For example, If you will take a loan amount of P3,000.00 with a service charge of 20%, you will only get P2,400 of your loan proceeds.

If you are a repeat borrower, Fast Cash will charge you.

- 15%

For example, If you will take a loan amount of P3,000 with a service charge of 15%, you will only get P2,550 of your loan proceeds.

Note: This rate and fees may change, depends on the approved loan amount and loan tenor.

Fast Cash also has a penalty fee of 2.5% daily for all delinquent (not paying on time) borrowers, and aside from that, they have a late payment fee of 5%.

That fees are high, which makes it harder to pay off your loans. That could be a huge burden to you, so to avoid such unwanted payment make sure to settle your payables on time.

Also, not paying on time will affect your credit score, and it would make it harder for you to get a loan in the future, even on other online lending and even banks. So, be a responsible borrower and always pay on time.

How to be Eligible for Fast Cash Loans

To be eligible for the Fast Cash loans, you should meet these qualifications listed below.

- Filipino Citizen currently living in the Philippines

- Age must be at least between 15 – 55 years old.

- Must have a stable income source

And that’s it! It’s not hard to qualify. That is actually one of the advantages of online lendings that offer a short-term loan. It can surely provide help during emergencies.

What are Fast Cash Loans Requirements

Here is what you need to prepare and present if you want to avail Fast Cash loan service.

- Valid ID

Yes, you only need 1 Valid Government Issued ID if you want to avail Fast Cash Loan. So if you qualify for Fast Cash eligibility and you have 1 Valid ID, then that means you are welcome to try Fast Cash loan service.

Here’s the list of Valid IDs that Fast Cash accepts.

- SSS

- UMID

- TIN

- Passport

- Drivers License ID

How to Apply for Fast Cash Loans

To apply for Fast Cash Loan, you need to download their mobile app first available on Google Play Store and Huawei App Gallery.

Fast Cash loan application has six (6) easy steps. And these are the following.

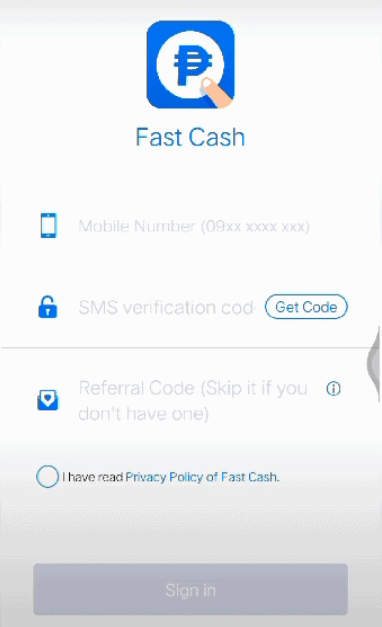

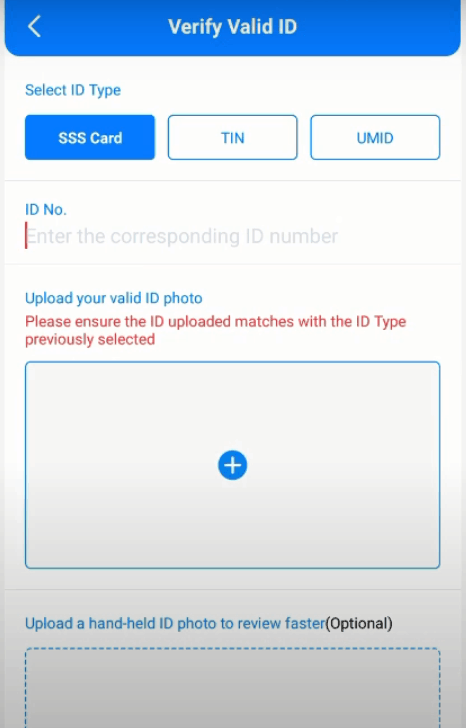

Step 1

Register your number and get the OTP code (sent via SMS) and click “I have read Privacy Policy of Fast Cash.”

Note: Register your own and active mobile number to avoid future problems.

After that, you need to verify your account with a Valid ID.

Here you will select your available Valid ID and ID no.—also, the picture of your Valid ID and a photo of you holding your ID. After you uploaded and provided all information, click SUBMIT.

Although uploading a hand-held ID is optional, it would be better if you provide that information for a higher chance of approval.

Note: Ensure that the ID you upload matches the ID you select.

Tip: Choose a plain or white background for your ID and hand-held ID. In that way, the Fast Cash system will recognize your ID and its information and give you a higher chance of approval.

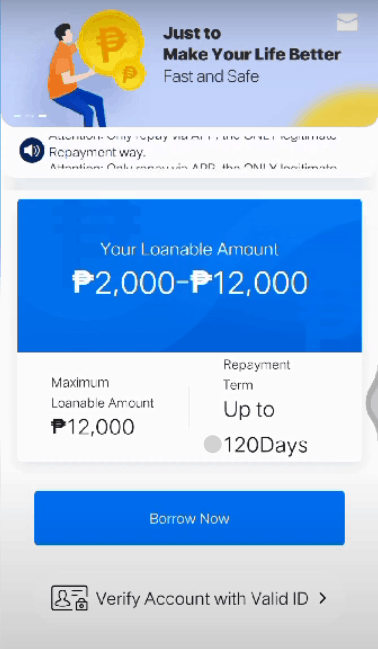

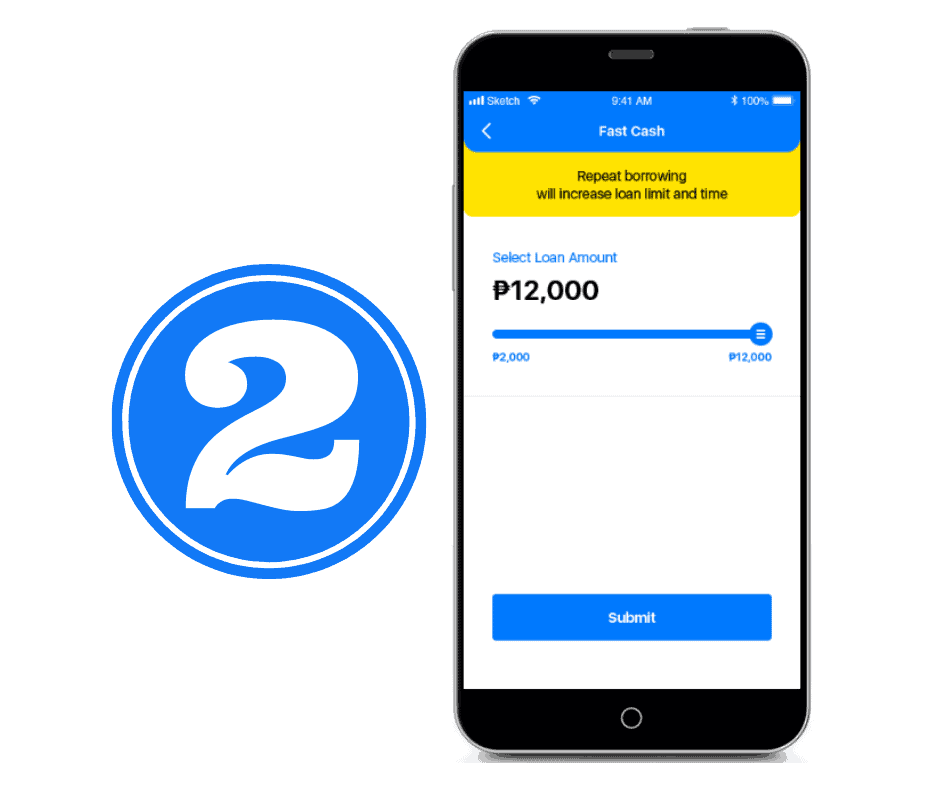

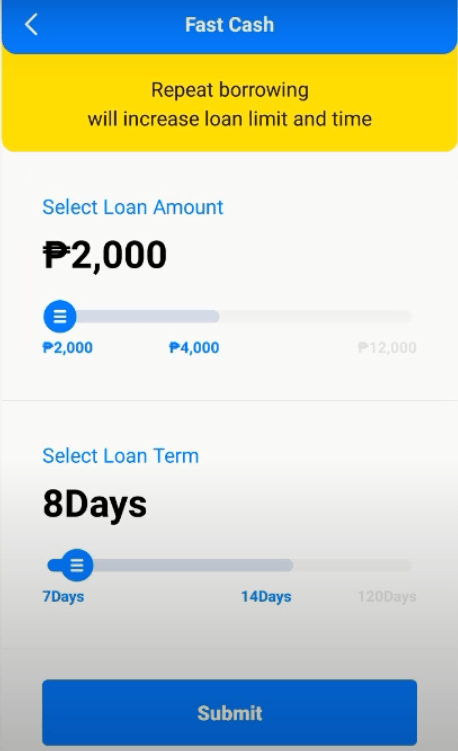

Step 2

Next, click “Borrow Now” and choose your desired loan amount and loan term.

All first-time borrowers can choose between P2,000.00 – P4,000.00 and loan term between 7 days – 14 days. After you select, click SUBMIT.

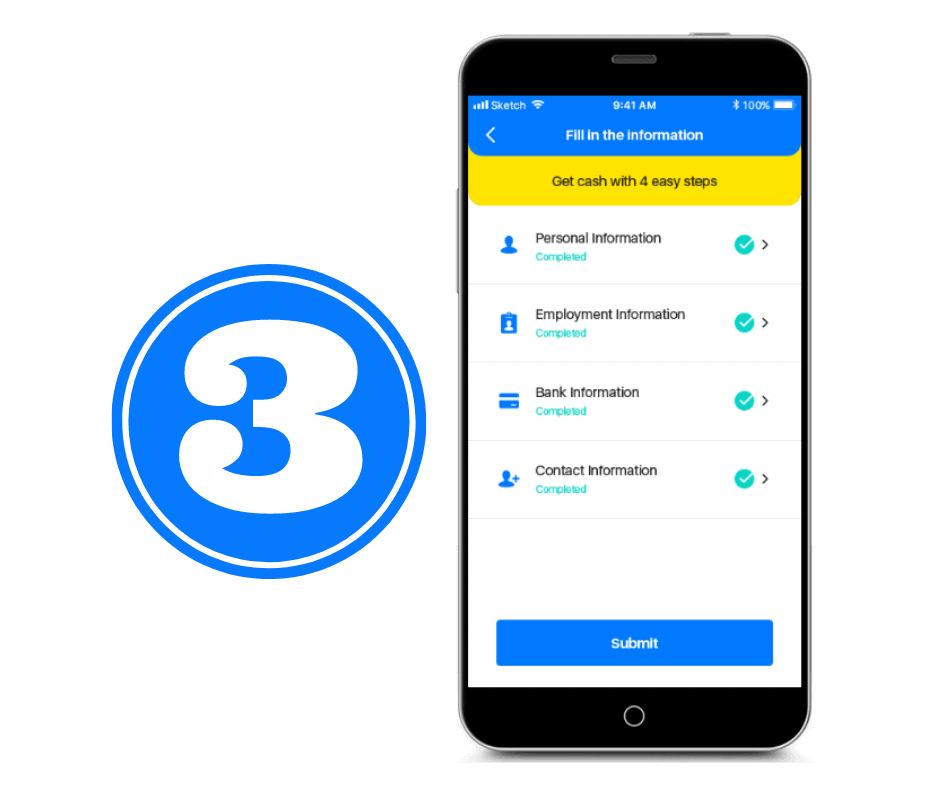

Step 3

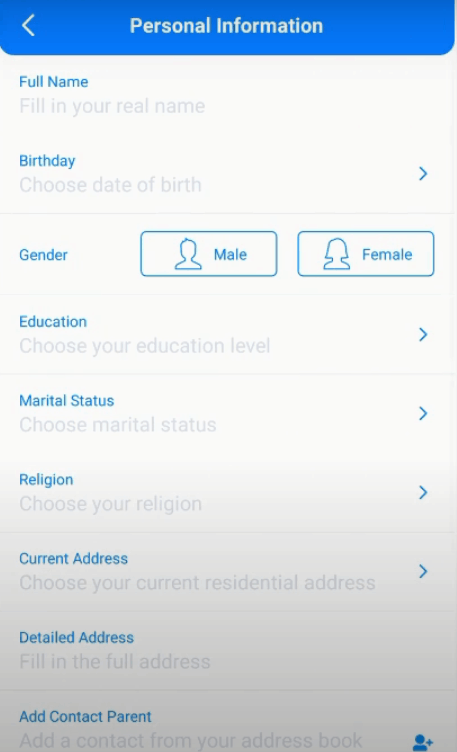

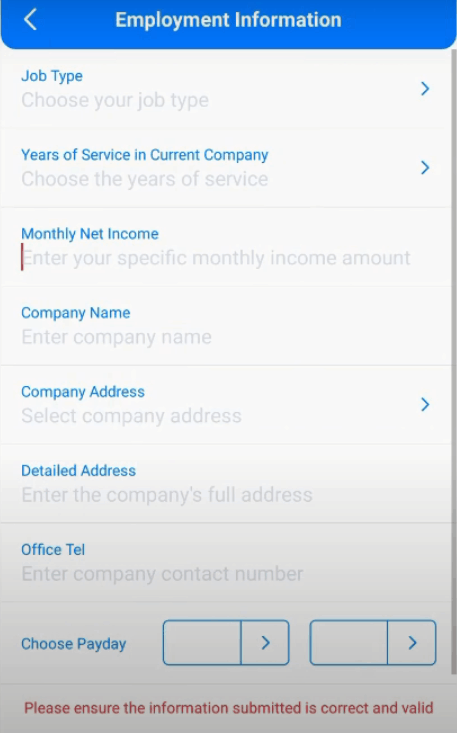

You need to fill in and provide personal information.

You need to provide

- Personal Information

- Employment Information

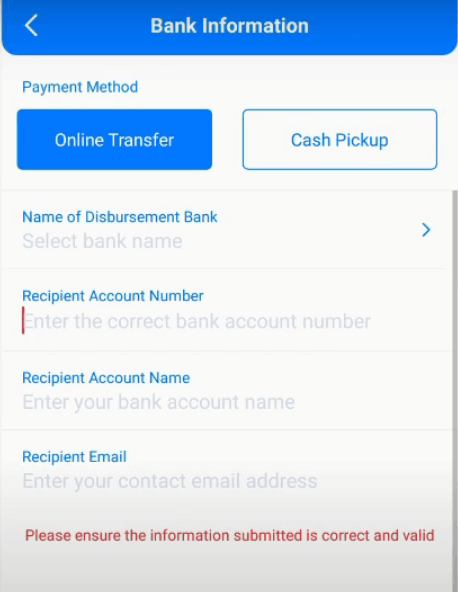

- Bank Information

Here you can choose your GCash account

- Contact Information

After you provide all the information, click SUBMIT.

After that, the breakdown information on your loan application will show.

Here you have an option to cancel or proceed with your loan. If you are okay with the loan proceeds and information, at the bottom, click ” I have read, understood, and agreed with loan agreement” and ” I have read, understood, and agree with disclosure,” then click SUBMIT.

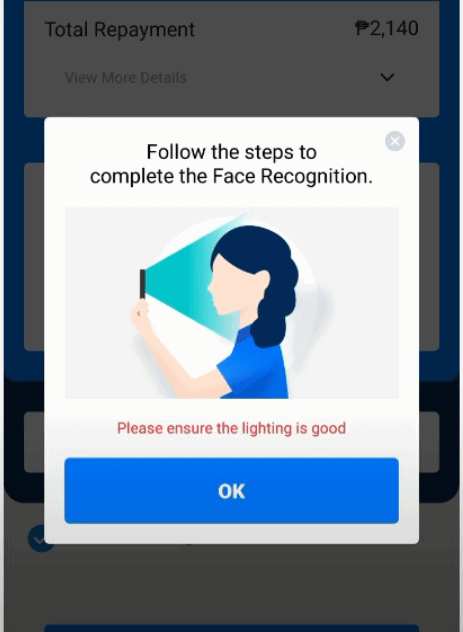

Step 4

Face Recognition

Just follow all instructions during face recognition.

Note: Ensure that the lighting is good and make sure that the picture of yourself is clear.

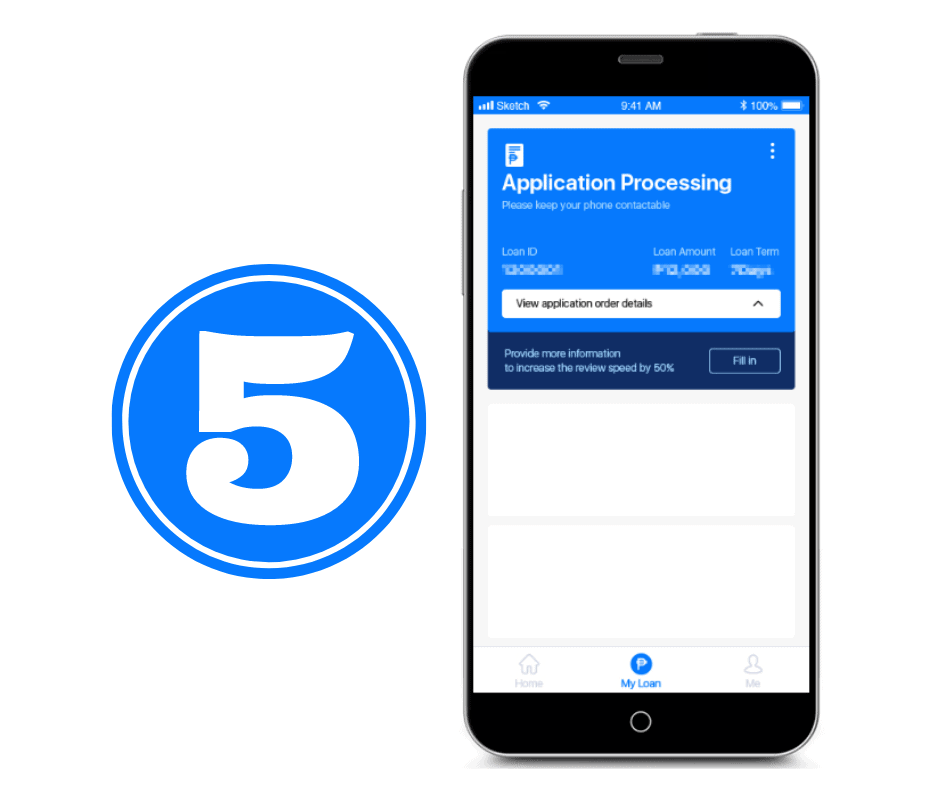

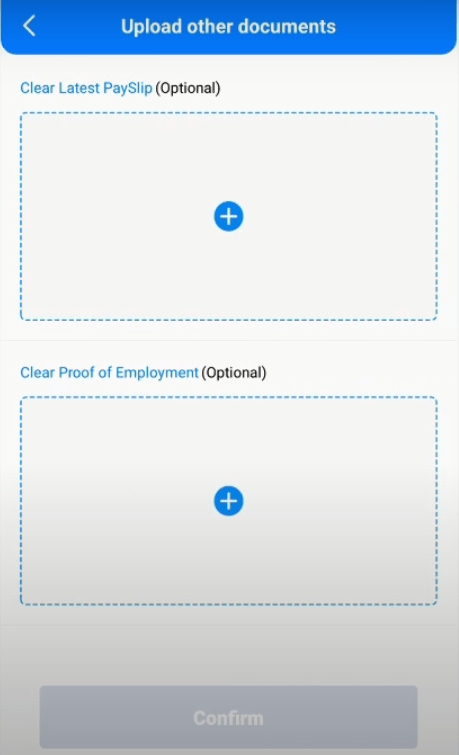

Step 5

After face recognition, details of your loan application will show.

If you want to increase your review speed, just provide more information. You only need to upload documents such as the latest PaySlip and Proof of Employment.

Step 6

After sending the loan application, you need to wait for loan application approval and disbursement. (Disbursement may take up to 24 hours, holidays and weekends are not included).

When and How can you Get the Money After Approval

After filling up all the information, you have seen on the loan application process. You need to wait for the approval. Time may vary, and during this time, you must keep your phone contactable since Fast Cash loans will call to finish the loan application process or confirm the loan approval, or they may send an SMS.

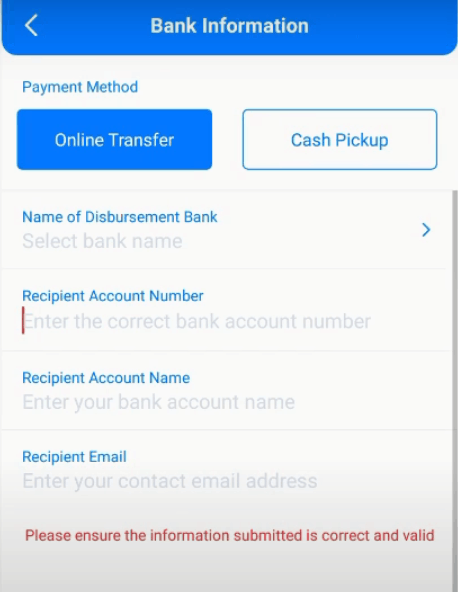

There are two (2) ways to get your money. You can choose between

- Online Transfer

- Cash Pickup

In online transfer, you can choose a Bank account or Gcash as a mode of disbursement.

While in Cash Pickup, you can select M.Lhuillier or Cebuana.

You can also check these videos if you want a tutorial or guide on how to apply for Fast Cash Loans.

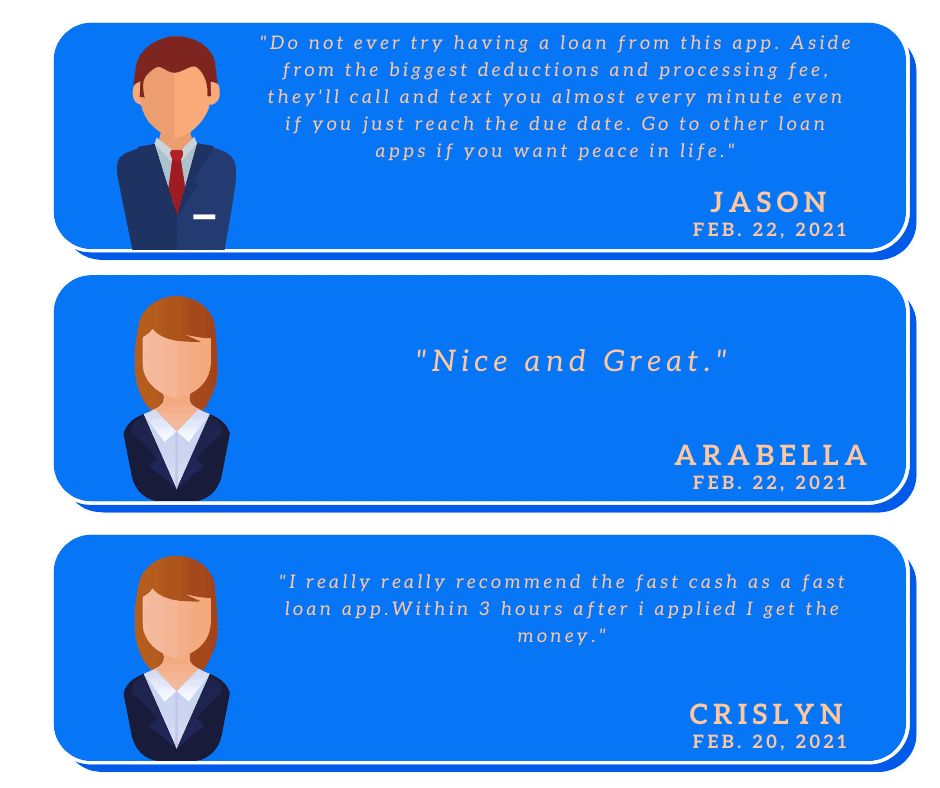

What Do Other People Say About Fast Cash Loans Service

These are some of the reviews of those who have tried Fast Cash Loans service. We select both negative and positive comments to show transparency on Fast Cash loan service. We also choose the latest reviews to give the latest updates on Fast Cash performance.

Have you tried the Fast Cash Loans service? We would also like to hear from you. You can leave your review in the comment section below. It would be a great help for others who are looking for information about Fast Cash Loans performance.

Fast Cash Loans Alternatives

Aside from Fast Cash loans, other online lendings also offer quick money. They also only require a Valid ID, and it is easy to qualify for a loan. These are the following.

- Robocash Online Loans – Offers loan for FREE for all first-time clients!

- Online Loans Pilipinas – Offers the first loan for free! 0% interest if you pay your first loan on time.

- KVIKU – You can loan a minimum amount of P1,000.00 and a maximum of P25,000.00

- MoneyCat – 100% online application, and you only need 1 Valid ID to apply!

- JuanHand – Get your cash in 5 mins.!

For more list of online lendings that offer quick cash, you can check it here.

If you are looking for a loan offer where you can loan higher amounts, you can try Banks Personal Loan as an alternative. The following banks offer high loanable amounts with low-interest rates and long terms. You can also check them out.

- Security Bank Personal Loan – You can loan a minimum amount of P30,000.00 and a maximum of P2,000,000.00 with a monthly add-on interest of 1.39% – 1.69%. They have a flexible loan term of 12 up to 36 months.

- CIMB Bank Personal Loan– You can loan a minimum amount of P30,000.00 and a maximum of P1,000,000.00 with a monthly add-on interest of 1.12% up to 1.95%. They have a loan term of 12 up to 60 months.

- PSBank Flexi Personal Loan- You can loan a minimum amount of P20,000.00 and a maximum of P250,000.00 with an interest rate of 2.5% for a revolving loan and 1.75% for a fixed loan. They have a loan term of 24 up to 36 months.

- HSBC Personal Loan- You can loan a minimum amount of P30,000.00 and a maximum of P500,000.00 with a monthly add-on interest of 0.65%. They have a loan term of 6 up to 36 months.

- Maybank Personal Loan- You can loan a minimum amount of P50,000 and a maximum of P1,000,000.00 with a monthly add-on interest rate of 1.3%. They have a loan term of 12 up to 36 months.

For more list of banks that offer personal loans, you can check it here.

First loan 0% fees 97% recommended Repayment: Up to 30 days Age: 21-70 years old Up to P25,000 Best Choice |

Interest Rate 0% at first loan 98% recommended Repayment: Up to 30 days Age: 20-65 years old Up to P20,000 Super Fast |

Waiting Time Instant Approval 95% recommended Repayment: Up to 180 days Age: 21-70 years old Up to P20,000 Best Loan |