Company Name: PALOO FINANCING, INC.

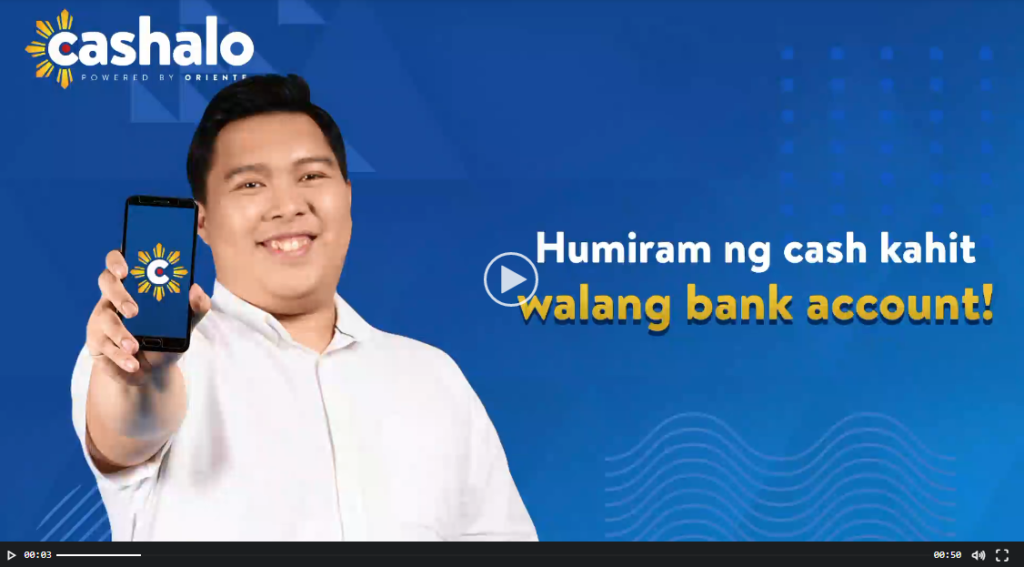

Cashalo is a lending platform here in the Philippines that offers loan services online. Cashalo loan service is available to anyone who has access to a network connection. You can avail of their loan product anytime and anywhere!

Cashalo aims to provide loan service that is fast, affordable, and secure through their mobile application that is available in Google PlayStore, App Store, and Huawei App Gallery.

Cashalo has three loan products.

- Cashaloan: Where you can loan cash that you can use for personal needs.

- Lazada Loan: Where you can shop on Lazada and pay later. All you need to do is cash up your Lazada Wallet through Cashalo loan, and you can pay later. Make sure you don’t have an existing loan at Cashalo to avail this Cashalo loan product.

- Pay with Cashalo: You can shop online and offline with Cashalo partner store/merchants and on their in-app e-store and pay later. Make sure you don’t have an existing loan to avail this Cashalo loan product.

Cashalo is a legal online lending company with an SEC Registration No. CS201800209 and Certificate of Authority (C.A.) No. 1162. This shows that Cashalo is working under the Philippines law, and you can trust their loan service.

Cashalo is operating under Paloo Financing Inc. This company finances all loans under the Cashalo Platform.

Cashalo Loan Contact Information

Website: Cashalo

Email: hello@cashalo.com

Address: 16F World Plaza, BGC, Taguig City, Philippines 1634

Hotline No.: (02) 8470 6888

Mobile No.:

- SMART – 09088804642

- GLOBE- 09171850178

Working Days:

- Weekdays – 9:00 A.M. to 8:00 P.M.

- Weekends – 9:00 A.M. to 6:00 P.M.

Contact Information for corporate inquiries

Hotline No.: (02) 8808-8388

Working Days: Weekdays, 10:00 A.M. to 5:00 P.M.

Cashalo Loan Feature

Cashalo Loan Minimum-Maximum Amount

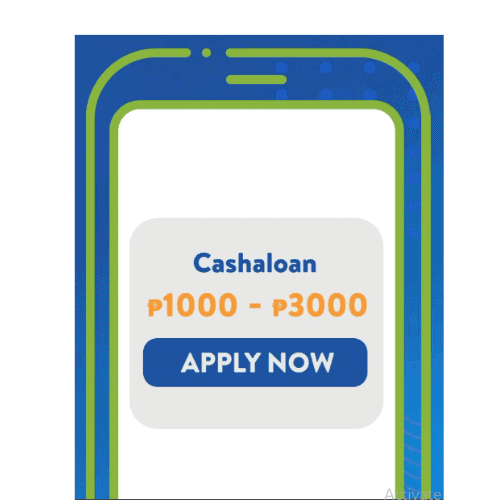

- CASHALOAN

Here you can loan an amount

- Minimum – P1,000.00

- Maximum – P5,500.00

It might increase up to P10,000.00 if you pay on time.

Your maximum loan amount may differ from others, especially to those repeat borrowers of Casahalo loan.

Want to increase your credit limit? All you need to do is be a responsible borrower and pay on time or advance and rest assured that Cashalo will increase your credit limit.

- LAZADA LOAN

Here you can cash up with up to P4,500.00.

- PAY WITH CASHALO

Here you can get a credit line as high as P2,000.00.

You can increase your credit limit by paying on time, and it may change monthly or every billing cycle.

Cashalo Loan Term

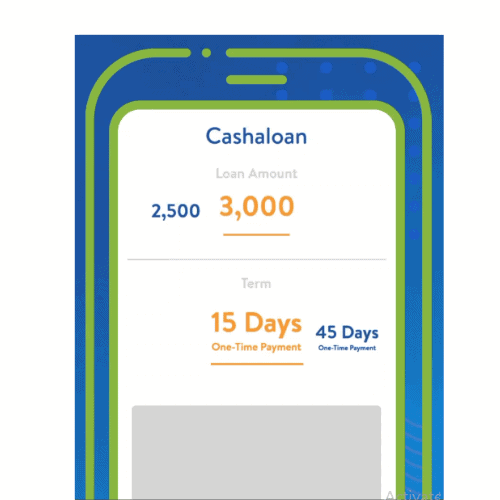

- CASHALOAN

Here you can select between

- Minimum – 16 days

- Maximum – 90 days

But, for all first-time borrowers, you can only choose between.

- Minimum – 16 days

- Maximum – 30 days

You can avail higher loan tenor by paying on time and leaving a good credit record.

So far, Tala and Cashalo offer the longest maximum tenor with 30 days loan term for all first-time borrowers.

- LAZADA LOAN

Here you can select from loan terms of up to 90 days.

It might increase up to 3 months. You only need to always pay on time and show that you are responsible and trustworthy so that Cashalo will increase your loan term available.

- PAY WITH CASHALO

The due date is 30 days after activation.

Cashalo Loan Interest Rate, Fees, and Charges

- CASHALOAN

This cash loan offer has the lowest interest rate, which starts at 3.95%

They have a loan calculator. Where you only need to slide left and right to select your desired loan amount and installments.

After you select, you can see at the bottom your Total Amount Due and the Due Date.

- LAZADA LOAN

Cashalo will show payment details as well as the interest rate during application.

- PAY WITH CASHALO

0% interest rate if you pay on-time!

Pay with Cashalo loan has a 5% Processing Fee.

Cashalo has a late payment fee. Make sure you pay on time or before your due date to avoid late payment fees on your account.

How to be Eligible for Cashalo Loan Product

These are the qualifications for every Cashalo loan product.

- CASHALOAN

- Filipino citizen

- Age must be at least 21 years old and above

- Employed of Self-employed with a stable income source

- LAZADA LOAN

- Filipino with a verified/activated Lazada wallet

- Must not have an existing loan at any Cashalo loan product

- PAY WITH CASHALO

- New Cashalo users and Existing Cashalo users can apply and activate their credit limit.

- Must not have an outstanding balance from other loan products of Cashalo loan.

Cashalo Loan Product Requirements

To apply for Cashalo Loan products, you need to prepare and present the following:

- Valid Government Issued ID

- Proof of billing/address

- Valid Work ID

- Recent Payslip

- Nominated Bank Account (optional)

- Activated Lazada Wallet (for Lazada Loan)

How to Apply for Cashalo Loan Product

To apply and avail of the Cashalo loan product, you need to download their mobile application available on the following.

- CASHALOAN

Step 1 Log-in your mobile number.

Note: Make sure that it is active and use your own mobile number for Cashalo will send your Verification code/OTP at your registered mobile number.

Step 2 Under Cashaloan product, click “APPLY NOW.”

Step 3 Fill in the loan application and complete your profile/personal information.

Step 4 Select the loan amount and terms that you desire.

Step 5 Choose your desired cash-out option. Here you can choose between your Bank account or your Paymaya account.

Step 6 Complete your loan application. After filling up, Terms and Conditions will appear. Click accept and enter the OTP code Cashalo sent to you via SMS

Step 7 Wait for the approval. If your loan is approved, Cashalo will send your loan application approval via SMS.

You can also refer to this link if you want a video tutorial.

- LAZADA LOAN

Step 1 Register

On the Homepage of your Cashalo loan app, under Pay with Cashalo, select Lazada Loan.

During filling up the information, make sure you will register the same mobile number and email address enrolled in your Lazada account.

Step 2 Apply

Click “APPLY NOW” and provide necessary, valid, and accurate information.

Step 3 Input Lazada Account

Under the cash-out option, input your Lazada Account.

During filling up the information, make sure you will register the same mobile number and email address enrolled in your Lazada account.

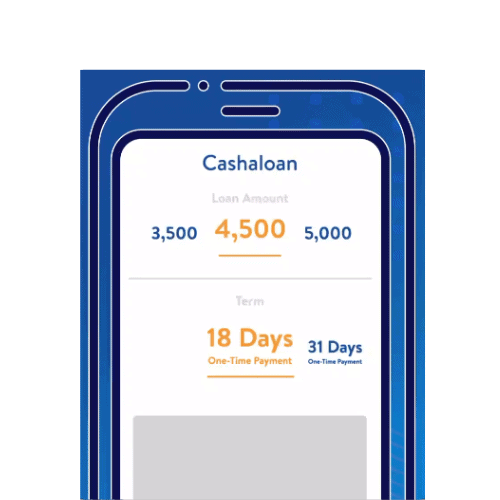

Step 4 Loan Amount and Tenor

Select your desired Lazada loan amount and payment terms. Here you can choose up to 90 days loan term.

Step 5 Verification

After filling up the loan application, terms and conditions will appear. Click “ACCEPT” to proceed with the loan application and input your OTP code sent by Cashalo via SMS.

Step 6 Approval

If you are approved, Cashalo will send you your loan application approval via SMS. You need to wait for at least 1 – 3 working days before Cashalo sends your loaned amount to your Lazada wallet.

If you want a video tutorial on how to apply for Lazada loan, kindly refer to this link.

- PAY WITH CASHALO

Open your Cashalo app, then click on Activate Pay later. Fill up the application and provide your information.

Make sure you input valid, honest, and accurate information to avoid rejection.

After filling up the application, Cashalo will notify you via SMS or Email when your credit line is ready for use.

When and How can you Get the Money After Approval

- CASHALOAN

There are two (2) ways to cash out your loaned money here at Cashalo

- Bank Account

- Paymaya

If your loan application were approved, Cashalo would disburse your money typically in less than 24 hours.

If you choose paymaya as your disbursement mode, your money will be sent to your paymaya account within 48 hours.

- LAZADA LOAN

Your money will be disbursed to your Lazada Wallet account within 3 business days.

- PAY WITH CASHALO

Cashalo will provide a flexible credit line that you can use for your everyday needs.

How and Where to Pay Cashalo Loan

There are 3 ways to pay your loan at Cashalo Loan.

- Online Banking

- Over the Counter

- Bayad Centers

ONLINE BANKING

- GCash

- Paymaya

- BDO Online Banking

- Robinsons Online Banking (has a transaction fee of P12.00)

Just follow these instructions while paying your loan through Online Banking.

OVER THE COUNTER

- ECpay (has a transaction fee of P20.00)

- TrueMoney

- BDO branches

- SM Business Centers

- Bayad Center

- Robinsons Bank Bills Payment

- Robinsons Business Center (located in Robinson’s department store)

- Digipay

- Remittance & Payment Center (via Dragonpay)

BAYAD CENTERS

- Cebuana Lhuillier Bills Payment

- LBC

For detailed payment instructions:

- Log-in to your account using the Cashalo app

- From the home screen, tap on My Loan icon.

- Press Pay Now

- Choose your preferred payment option

Posting of payments here at Cashalo may take up to 1 – 2 working days before it gets reflected on your Cashalo account.

If your payments still haven’t posted with the said time frame, you can contact Cashalo by filling up this form:

What do Other People Say About CashJeep Loan Service

These are some of the reviews and feedbacks of Cashalo loan customers. Their experiences differ from each other, and it may be different with you too. You can use this information to help you to decide whether you avail Cashalo loan product or not.

We choose the latest and updated reviews to show you the updated information on Cashalo loan service performance. We also select both negative and positive reviews to show transparency on Cashalo.

From what you have seen, there are definitely pros and cons while using Cashalo.

The pros or advantages are that Cashalo is legit, and you can really take up a loan here. This means their loan service can really help when you need financial assistance. They also offer better Customer service, unlike other online lending company that has rude and unmannered agents that will harass you.

The cons or disadvantages are that others got problems reloaning even though they are a good payer of Cashalo. Others also complained about Cashalo calling, asking you to pay your loan even though you still have three days before your due. While others got problems during payment, most of the fuss is that their payment hasn’t been reflected until it’s past due, where penalties are charged.

Have you tried Cashalo? If so, why not leave your personal review in the comment section below of this article. We would also like to hear from you, and it would be a great help for those looking for information about the Cashalo loan service.

Loan Alternatives

Aside from Cashalo, other online lendings also offer fast cash. They also only require a Valid ID, and it is easy to qualify for a loan. These are the following.

- Robocash Online Loans – Offers loan for FREE for all first-time clients!

- Online Loans Pilipinas – Offers the first loan for free! 0% interest if you pay your first loan on time.

- KVIKU – You can loan a minimum amount of P1,000.00 and a maximum of P25,000.00

- MoneyCat – 100% online application, and you only need 1 Valid ID to apply!

- JuanHand – Get your cash in 5 mins.!

For more list of online lendings that offer quick cash, you can check it here.

If you are looking for a loan offer where you can loan higher amounts, you can try Banks Personal Loan as an alternative. The following banks offer high loanable amounts with low-interest rates and long terms. You can also check them out.

- Security Bank Personal Loan – You can loan a minimum amount of P30,000.00 and a maximum of P2,000,000.00 with a monthly add-on interest of 1.39% – 1.69%. They have a flexible loan term of 12 up to 36 months.

- CIMB Bank Personal Loan– You can loan a minimum amount of P30,000.00 and a maximum of P1,000,000.00 with a monthly add-on interest of 1.12% up to 1.95%. They have a loan term of 12 up to 60 months.

- PSBank Flexi Personal Loan-You can loan a minimum amount of P20,000.00 and a maximum of P250,000.00 with an interest rate of 2.5% for a revolving loan and 1.75% for a fixed loan. They have a loan term of 24 up to 36 months.

- HSBC Personal Loan-You can loan a minimum amount of P30,000.00 and a maximum of P500,000.00 with a monthly add-on interest of 0.65%. They have a loan term of 6 up to 36 months.

- Maybank Personal Loan-You can loan a minimum amount of P50,000 and a maximum of P1,000,000.00 with a monthly add-on interest rate of 1.3%. They have a loan term of 12 up to 36 months.

For more list of banks that offer personal loans, you can check it here.

Disclaimer: These pieces of information are all based on our thorough research on different platforms. We gather this information and made this Cashalo loan review to give you guides and ideas on Cashalo loan service. We are not promoting CashJeep, nor they partnered with us to promote their service. If you want to try their service, we suggest you do further research about them and think twice. Applying is your own decision, and we are not reliable with any damage or loss.

First loan 0% fees 97% recommended Repayment: Up to 30 days Age: 21-70 years old Up to P25,000 Best Choice |

Interest Rate 0% at first loan 98% recommended Repayment: Up to 30 days Age: 20-65 years old Up to P20,000 Super Fast |

Waiting Time Instant Approval 95% recommended Repayment: Up to 180 days Age: 21-70 years old Up to P20,000 Best Loan |

Pingback: Top 5 Legit Fast Cash Loan App in the Philippines in 2021 - Pinoy Moneys