Searching for the best loan apps in the Philippines? Loan app lowest interest, is there anything like that? Yes! It’s existing. The Fintech world is inside your Smartphone! Read on to know how to get a loan online using your mobile phone and your valid ID.

Pandemic hits very hard in 2020, especially the economic impact on the regular employees to startups and small business owners. If you’re one of these or were curious about what we’re talking about, the best online loan app in the Philippines, then read on.

Almost everyone claims to be the best in the field, but nobody guarantees fast approval as this best online loan app in the Philippines. There were those tops and those bests, but not everyone is number one. This best loan app suits you if you’re on the lookout for quick cash to meet your ends.

You don’t have to go banking and have paper-documented everything with all the hard-to-get requirements and long queue lines, which you will have to wait for the next 30 days only to find out that it is disapproved. In this fast-paced technology era, the country has the best online loans. Take a look at these top 10 listed online loans with monthly payments.

Digido Philippines

Haven’t you heard of Digido Philippines yet? This company claims an instant online loan of 10,000 pesos.

How long it takes to approve

They offer emergency loans for bills payments and check this out business capital in as fast as 5 minutes. No way? Yes, you heard it right.

Company Overview

Digido is a legit, fully legal company with SEC Registration No.: 202003056, and Certificate of Authority No. 1272. It offers a fully automated lending system that makes independent decisions based on the data on each application. They uphold on committing to lending rules and regulations without compromise. Best of this, they adhere to not indulging in unethical practices such as inflating higher interest rates for those with bad credit history and or hidden charges and upfront commissions.

How to Apply

For this company, they make everything as easy for everyone. You have the option to make your loan on an online website, or you can visit their office. Visit their website digido.ph, or you can download their mobile app on Google Play Store. You can borrow with a minimum of 10,000 up to 25,000 for 180 days for repeated loans. Digido will do all operations online, and no need to leave your home.

The first step to do is to create your account on their platform. The online loan system will ask you for the desired amount of loan, and then you will have to provide your data like cellular/mobile phone number to register. Click on the Privacy and Terms and Conditions and then hit “Apply Now.”

And for additional steps to follow, they would have to ask for some personal data, and you have to provide your employment details. Your money will then be transferred within a few hours if approved in the last step.

Requirements

All Filipino residents are eligible to apply. Must be at least 21 to 70 years old to be qualified. Must be employed individuals and those selected professionals.

Applicants should have access to a working mobile connection. They were required to submit the government-issued identification card with proof of employment such as COE, ITR, company ID, and DTI for self-employed or business. Offering these requirements is necessary to increase the chances of loan approval. No collateral and guarantors are needed.

Repayments

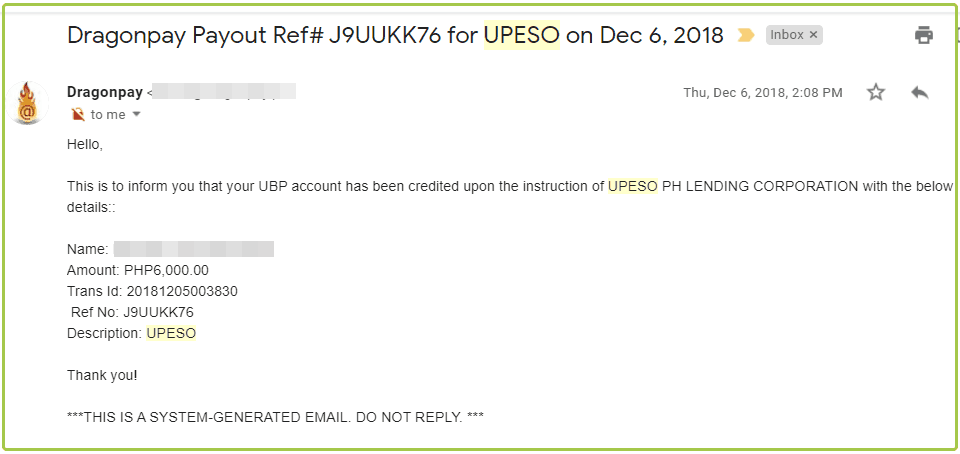

There are many loan repayment options like bank transfer, through remittance center, 7-Eleven, Dragonpay, and or to their offline branches. Payment terms to choose of 3, 4, 5, and or six months.

Interests and Charges

Now, this one is interesting. The first loan of PHP 1,000 to 30,000 offers no interest for seven days. Great help for starters who were still building a credit history. Digido Philippines has a maximum annual loan rate of 143% or 11.9% per month. A loan calculator in their platform will help you decide before subscribing to any loans.

Online Loans Pilipinas

How long it takes to approve

Get approved and instant money disbursement in less than 5 minutes.

Company Overview

Online Loans Pilipinas is SEC Registered financing company with a registration no. CS201726430 and Certificate Authority No. 1181. Their office locations at Unit 1402-06 14th Floor Tycoon Centre, Pearl Drive, San Antonio, Pasig City.

How to Apply

There are four easy steps to get a cash loan. First, you need to apply for a loan and complete this application in 3 minutes. Visit their website olp.ph and or you may download their mobile app in Google Playstore and Huawei AppGallery. You can get your loan with a minimum of PHP 1,000 to PHP 7,000. And you will get as much as PHP 8,000 up to a maximum of PHP 20,000 for repeated borrowers only.

Using their online loan calculator, hover into the spectrum for your desired amount of loan, and then after, you need to provide your mobile number and hit the button “Get first loan” to create and register your account. Be prepared for additional requirements the system might need. Wait for approval within just a few minutes, send thru SMS or receive via call. Then, if approved, you’ll get the money transferred in less than 5 minutes via InstaPay.

Requirements

Eligibility requirements include all residents located in the Philippines nationwide. Must be at least 22 years of age up to 70 years old. Applicants should be employed individuals or selected professionals. Should have a valid bank or e-wallet account. No collateral is needed, and no payslips or proof of billing is required; only 1 valid ID (TIN, Passport, PRC, UMID, SSS, Driver’s License)

Repayments

Multiple repayment channels are available in Online Loans Pilipinas. You can pay over-the-counter (7-Eleven, Bayad Center Cebuana Lhuillier, Palawan, LBC), Gcash, Coins.ph, or online banking via Dragonpay. In their loan calculator, the first payment date is indicated after ten days of an approved loan before proceeding with your loan.

They offer flexible repayment terms in case of unforeseen circumstances, and you can get 30 days of extension (provided no fault of the borrower).

Interests and Charges

Get your first loan free of 0% interest charge when you repaid on the first payment.

Moneycat

Financial solutions easily and quickly through Moneycat services.

How long it takes to approve

A fast and straightforward transaction that only takes 5 minutes to complete registration and get money transferred within 24 hours.

Company Overview

The company is legit operate under the corporate name MoneyCat Financing Inc. located at Unit 1701 Tycoon Bldg. Pearl Drive St. Brgy. Antonio Ortigas Center Pasig City Philippines 1800. With Certificate of Authority to work under Number 1245 granted by the Securities and Exchange Commission.

How to Apply

Customers choose MoneyCat because it’s simple, fast, and convenient. To get a loan, you need to sign up on their online platform, visit moneycat.ph, or download their mobile app on Google Playstore. Fill out the online registration form that, only takes 5 minutes. You need to provide any document, your mobile phone number, and you need to have a bank account in your name.

Wait for the authentication code (OTP) to be sent through SMS and confirm the application. Wait for advice from one of its officers. They will contact you for appropriate financial solution advice to confirm terms, conditions, contracts, and loan needs. If approved, MoneyCat will transfer money in your account within 24 hours.

Requirements

In MoneyCat, you don’t need to confirm income, bring references or visit their office. All you need is to sign up in your name and provide your mobile phone number and email to apply. Eligibility requirements must be at least 22 years old, all Filipino residents living in the country, and employed individuals or selected professionals.

Repayments

There are multiple options for repaying your loan. You could pay via online banking, e-wallets, or over-the-counter payment centers. You could pay thru their payment partners like Western Union, Cebuana Lhullier, LBC, Palawan Pawnshop, etc.

Interests and Charges

In case of payment terms fall on the weekend, they advise paying earlier to prevent interest rate increase. Payment terms are 3 to 6 months, and the interest rate is 11.9% per month with a maximum APR of 145 %.

UnaCash

It claims to be the fastest cash loan in the Philippines.

How long it takes to approve

Get convenient and fast loan approval within just 5 minutes.

Company Overview

Digido Finance Corp runs Unacash. Operating as SEC licensed financing company with SEC Registration No. CS202003026 and Certificate of Authority No. 1272. Office located at 15th Floor The IBP Tower, Jade Drive, Ortigas Center, San Antonio Pasig City 1605.

How to Apply

Apply for a cash loan minimum of Php 1,000 and Php 50,000. No hassle loan application and seamless procedure, simply visit their site unacash.com.ph Or you can also download the mobile app at Google Playstore and Huawei Appl Gallery. The first step is to fill in your data. And then, hover into the spectrum and choose your desired loan amount. In their loan calculator, you can select your monthly loan terms. Click the “Apply Now” button. Wait for the approval less than 24 hours approval time after data validation. And then get your money.

Now this one is quite interesting. Unacash will provide you with a credit line for an approved amount of loan that you can cash out or spend to buy items from their partner merchants. It allows you a “buy now, pay later” scheme from a 0% interest rate.

Requirements

To be qualified in UnaCash, you need to be at least 18 years old and a Filipino citizen. You should have a valid email address and a mobile number. No bank account or credit card to use UnaCash.

Repayments

You may opt to pay thru e-wallets – GCash and or an online bank transfer using the UnaCash app. You can also pay offline at their partner stores such as 7-Eleven, Bayad Center, Cebuana Lhuillier, M Lhuillier, and The SM Store.

Interests and Charges

Depending on the client’s credit score, the interest rate is from 3% to 10% per month. Low-interest rate of 194% APR. Payable in monthly installment of 1 to 6 months, depending on your chosen terms.

Kviku

How long it takes to approve

Borrow up to Php 25,000 for up to 180 days of terms, disbursed in 5 minutes.

Company Overview

Operating under the corporate name Kviku Lending Co. Inc, located in 18A Trafalgar Plaza, 105 H.V. Dela Costa St., Salcedo Vill. Makati City. Operating legally under SEC Registration No. CS201918702 and with Certificate of Authority No. 3169. NPC Registration No. PIC-001- 791-2021

How to Apply

To apply, visit their website kviku.ph. You can borrow a minimum of Php 500 up to Php 25,000. Choose the desired amount you need and your loan payment terms of 60 days or 180 days. The online calculator will calculate your total repayment and your first payment date. If you have decided on your terms, then the next thing is to hit the “APPLY NOW” button.

There were only three steps to get a cash loan. Just fill in the application form online take a picture of yourself and your document. Wait for the approval in just a few minutes, and you will receive an SMS with a decision on your loan application. Lastly, receive the money instantly. Will then be transferred money to your bank account within 60 minutes.

Requirements

They only require one valid government ID. For self-employed or businesses, it might need additional supporting documents such as payslip, COE, ITR, company ID, and DTI. You must be a Filipino citizen of at least 20 to 55 years old. An active mobile number that is not blocked and registered on their website.

Repayments

On their website, you can repay your loan with a bank card. Just click the “Pay” button. You can also pay the loan in cash by depositing it into their bank account. You may also opt for early repayment of your loan within 60 days from the contract’s start.

Interests and Charges

Installment loan with a daily interest rate of 0.16 %.

TALA Philippines

Claims fast, flexible and secure loans at your fingertips.

How long it takes to approve

Within 24 hours turnaround time, loan approval in 5 minutes.

Company Overview

Tala Philippines is a secure and trusted financial partner registered under SEC Registration No. CS201710582 and operating with Certificate of Authority No. 1132. Tala is a global technology company that claimed the world’s most accessible financial services.

Tala is on a global location such as Kenya, Mexico, the Philippines, and India. CEO Shivani Siroya founded it.

How to Apply

To apply, just download the Tala mobile app in Google Playstore or AppGallery. In a few minutes you will complete the application process. Just follow the steps in the mobile app during the loan application. Choose the desired amount to loan and then decide your preferences for loan terms. Finally, select your disbursement method.

If approved, money will be transferred within 24 hours or depending on the cashout option selected. Cashout thru Padala Centers, nominated bank account, or Coins.ph

Requirements

It could help in your chances of approval if you had a valid Government ID and an Android mobile phone to apply in Tala. Valid government-issued ids such as SSS ID, UMID, Voter’s ID, Passport, Driver’s License, PRC ID, or Postal ID

Repayments

You may opt to pay in whole or installment on your due date or earlier than your due date. Select your payment partners via 7-Eleven, Cebuana, M Lhuillier, or Coins.ph

Interests and Charges

Tala’s effective APR is 183% to 191%. You will never be charge more than the amount of your service fee. Interest and payments do not compound or accrue. The interest rate is one-time, 11% for 21 days or 15% for 30 days. That would be 0.5% interest in a day.

Unapay

A buy now and pay later scheme payable by installments.

How long it takes to approve

Complete the registration form and get money in as fast as 5 minutes.

Company Overview

UnaPay is a legit company by Digido Finance Corp. Duly registered as a corporation with a Certificate of Authority No. 1272 to Operate as a Financing Company issued by SEC with Registration No. CS202003056.

How to Apply

To apply, visit unapay.com.ph and fill out the application. It take less than 10 minutes to complete the filling the application provided you have the complete set of documents. Submit a primary ID and proof of income.

Pre-approval is within 5 minutes, and then final approval. If found out there’s something that needed verification, the overall process would take 48 hours, depending on the availability of contact points.

Requirements

Must be at least 18 to 60 years old to apply. All Filipino citizens are eligible. Must have a valid email address and a mobile number. You must submit or show two documents, such as your valid Philippine government ID and proof of income.

There’s no need for a bank account or a credit card to use UnaPay.

Repayments

An email is sent for the loan amortization schedule and will an SMS notification or will send reminders once your due date is near. To pay your loan online, go to www.unapay.com.ph, click “REPAYMENTS,” and choose “Pay via Online.” Select their online payment partners through an e-wallet like GCash or via online transfers such as Unionbank, BDO, BPI, RCBC, PNB, or Metrobank.

Interests and Charges

There were no processing fees and no hidden charges. Interest rates are from 3% to 16% per month, depending on the client’s credit score.

Cashalo

So you want a cash loan, Lazada loan, or a buy now pay later offer? Name it, Cashalo has it.

How many days to approved

Within just 24 hours, your money will be deposited to you once approved. Try also considering the 30 minutes approval time.

Company Overview

Cashalo is operated and financed by Paloo Financing Inc., with SEC Registration No. CS201800209 and working with Certificate of Authority No. 1162. Located at 16F World Plaza, BGC, Taguig City Philippines 1634.

How to Apply

To apply for a cash loan:

- Download their Cashalo mobile app in Google Playstore or AppGallery.

- Log in with your mobile number and tap the “Apply Now” button under cash loan.

- Fill out the registration form and complete your profile.

- Choose the desired loan amount and then your loan terms.

- Select your cash disbursement option. You can either nominate your bank account thru your e-wallet GCash or PayMaya account to cash out.

Complete the application process and wait for your loan approval. Once approved, money is disbursed with a minimum time of fewer than 24 hours. Processing time may vary depending on cut-off (holidays and weekends).

Requirements

Along with the information you provided to complete your profile, they needed this requirement such as a government-issued ID, your proof of billing for your personal information, Company ID, and or your payslip for your work information. In other cases, some customers had been asking for the company number your bank account details, and they would ask for your email.

Repayments

You could pay via Robinson’s bank online banking or Robinson’s bank over-the-counter. You may opt for other payments available over-the-counter via Dragonpay. Select your source for payment centers at any 7Eleven store.

Interests and Charges

They have the lowest and most affordable non-bank interest rates in the market. They promise monthly interest rates of 4.95% (for 2,000 – 5,000 loan amount). But it ranges from 3.95% to 5.95%, it depends. Compared to other online cash lenders who take up to 15% interest rates.

You will be charged up to 4% for a one-time processing fee. But it won’t take up to the amount of money you will receive. The total amount of your loan will be deposited to you.

If the borrower will be a delay in loan payment, it is subject to late payment fees under your loan agreement.

LoanChamp

FlexLoan for every Filipino.

How many days to approved

Get a fast credit decision within 1 hour. (Operating hours are 10 AM to 7 PM on weekdays.)

Company Overview

LoanChamp is financed and operated by Y Finance Inc., established in 2017. Swift, Innovative and Reliable financial technology solution for every Filipino.

How to Apply

LoanChamp is offering FlexLoan, a multi-purpose cash loan. Borrow a minimum of Php 2,000 up to Php 20,000

Requirements

Eligible loan borrowers are Filipino citizens at least 20 years of age. Should have one valid government ID, mobile number, and an active social media account. For employed individuals, you must submit at least one month’s payslip or a Certificate of Employment. For self-employed individuals, submit your ITR or Business Permit.

Repayments

Choose loan payment terms from 61 days to 180 days.

Interests and Charges

You should be aware that the interest rate is from 0.35% to 0.50% of your loan amount.

Take note of the upfront processing fee for 5% of the loan amount, loan disbursement fee, and handling fee of P0 to P65. Missed payments are subject to late payment fees and penalty rates.

BillEase

Offers an affordable installment on leading online merchants.

How long it takes to approve

Up to 70% chances of getting approved on the spot; otherwise, it takes one banking day.

Company Overview

BillEase is a business style name and a product of First Digital Finance Corporation, registered in SEC as a financing company with Certificate of Authority No. 1101 and by the Bangko Sentral ng Pilipinas as Operator of Payment System (OPSCOR-2021-0007).

How to Apply

To apply, visit their website billease.ph or download the mobile app on Google Playstore and AppStore. In the loan calculator online, select the desired amount of loan. You may opt for a downpayment and then select loan terms of installments 2 to 24 months maximum. BillEase will calculate your installment amount before you decide on clicking the “Apply Now” button.

Submit your requirements online. Check your email or login into your account to see your initial credit limit approved. Use your credit limit on Lazada or any BillEase merchant partner.

Requirements

The applicant should be at least 18 years old and should have a stable source of income to be qualified. Eligible applicants should have at least one valid ID, proof of income, and proof of billing.

Repayments

Pay your installments via direct bank transfer, thru e-wallet, 7-Eleven, or at over 22,000 over-the-counter payment channels.

Interests and Charges

BillEase provides the lowest interest rate at only 3.49% monthly. You can avail of 0% APR on select merchants when you sign up.

Conclusion

Traditionally, a typical lender would opt for a bank loan for terms of security and flexibility. Time and accessibility to the required documents are somehow limited when an emergency strikes at an unknown possibility. Online loans are the easiest way, most accessible, and fast disbursement of money. The world condition changes how we think, and we now prefer safe and remote accessibility. Financial Technology is a game-changer for most Filipinos, especially the unbanked and unemployed.

Misconception about loans could lead to a more stressful situation, falling into a pit of debt. But practically, loans can help you leverage your financial health only when taken responsibly. So we adhere to a more responsible borrower and good healthy financial management.

First loan 0% fees 97% recommended Repayment: Up to 30 days Age: 21-70 years old Up to P25,000 Best Choice |

Interest Rate 0% at first loan 98% recommended Repayment: Up to 30 days Age: 20-65 years old Up to P20,000 Super Fast |

Waiting Time Instant Approval 95% recommended Repayment: Up to 180 days Age: 21-70 years old Up to P20,000 Best Loan |

Pingback: The 10 Best OFW Loans in the Philippines - Pinoy Moneys

Pingback: Best Online Loan App In The Philippines With Instant Approval - Pinoy Moneys

Pingback: Top 10 Ways To Make Money On TikTok In The Philippines

Pingback: Top 5 Best Loan Apps With The Lowest Interest - 100% Legit

Pingback: Online Loans Pilipinas Review 2022 - Instant Reloan To GCash Without Deduction - Pinoy Moneys