Company Name: Tala Financing Philippines Inc

Tala is one of the most well-known online lending platforms here in the Philippines. Tala Philippines loan service is available in other areas of the world, like in Mexico, India, and Kenya.

Tala Philippines loan is available for anyone who has an Android smartphone running on Android 4.1 and above. This application is not available on IOS devices, Android tablets, and Windows phones.

- Tala Philippines Loan Contact Information

- Tala Philippines Loan Feature

- Tala Philippines Loan Minimum – Maximum Loan Amount

- Tala Philippines Loan Term

- Tala Philippines Loan Interest Rate, Fees, and Charges

- How to be Eligible for Tala Philippines Loan

- Tala Philippines Loan Requirements

- How to Apply at Tala Philippines Loan

- When and How can you Get the Money After Approval

- How and Where to Pay Tala Philippines Loan

- What do Other People Say About Tala Philippines Loan Service

- Loan Alternatives

Tala aims to help borrowers build their financial status over time, that’s why they make it a mission to deliver fast and personalized loans to approved borrowers, regardless of their credit or financial history.

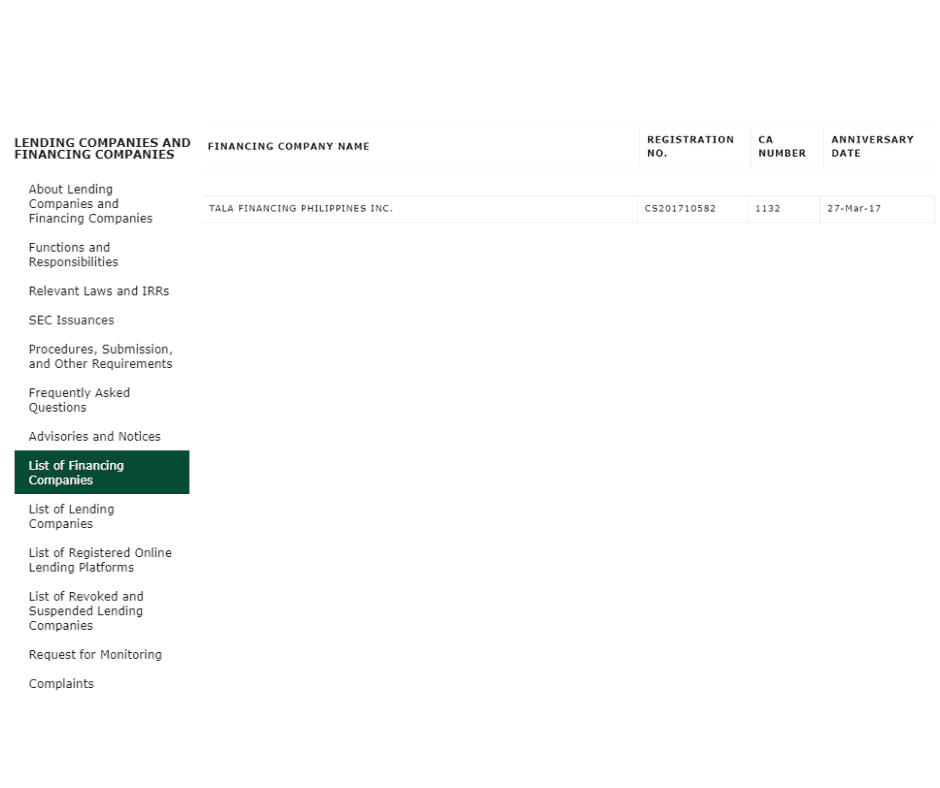

Tala is a legal online lending platform and is operating under the Philippines Law. When you look at the website of sec.gov.ph, you can see that Tala Philippines is SEC. Registered with a No. CS201710582 and Certificate of Authority (to operate as a financing company) No: 1132

Tala Philippines loan service is available 24/7, which means you can take a loan anytime and anywhere through the Tala app!

Tala Philippines Loan Contact Information

Email: support@tala.ph

Website: Tala Philippines

Tala Philippines Loan Feature

Tala Philippines Loan Minimum – Maximum Loan Amount

For all first-time borrowers, Tala Philippines loan will let you loan an amount.

- Minimum – P1,000.00

- Maximum – P2,000.00

But it can grow up to P15,000.00 if you pay on-time regularly.

Tala Philippines loan decisions are based on many factors, including your loan application, mobile money data, and identity verification points. If you want to qualify for a higher loan, Tala Philippines advises that you keep a good credit record by paying on time.

Your credit limit will grow over time. This means you can’t avail of the maximum loan amount of P15,000.00 on your second loan yet. Tala borrowers qualify for one limit increase per month with regular use.

Tala sets a credit limit to build trust on both sides. If Tala sees that you are responsible and can be trusted cause you always pay on time, rest assured that Tala Philippines will increase your credit limit.

Tala Philippines Loan Term

Tala Philippines will let you select a loan term between

- 21 days

- 30 days

So far, Tala Philippines is the one that offers a longer loan term even for first-time borrowers, where you can select 30 days as your loan term.

If you are looking for a loan where you can select a longer loan term, then Tala Philippines is the best choice.

Tala Philippines Loan Interest Rate, Fees, and Charges

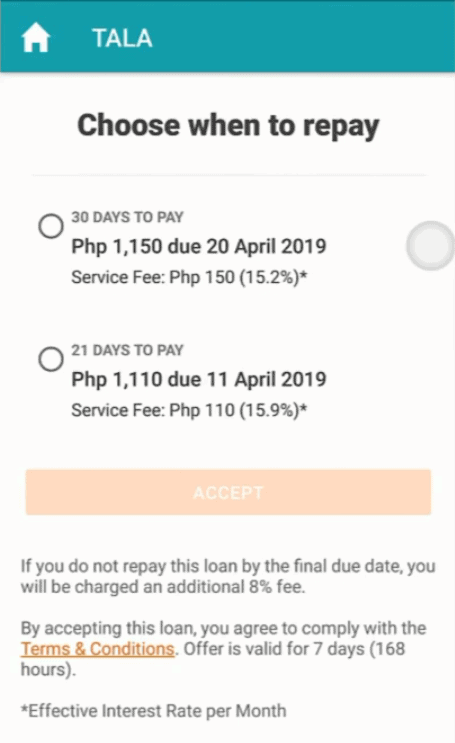

Tala Philippines loan will charge a one-time fee of:

- 11.4% – 13.3% + applicable taxes for loans with a loan term of 21 days

The Annual Percentage Rate (APR) is

- 198% – 231%

The Effective Interest Rate (EIR) per month is

- 12% – 14%

- 15.2% – 17.1% + applicable taxes for loans with a loan term of 30 days.

The Annual Percentage Rate (APR) is

- 185% – 208%

The Effective Interest Rate (EIR) per month is

- 16% – 18%

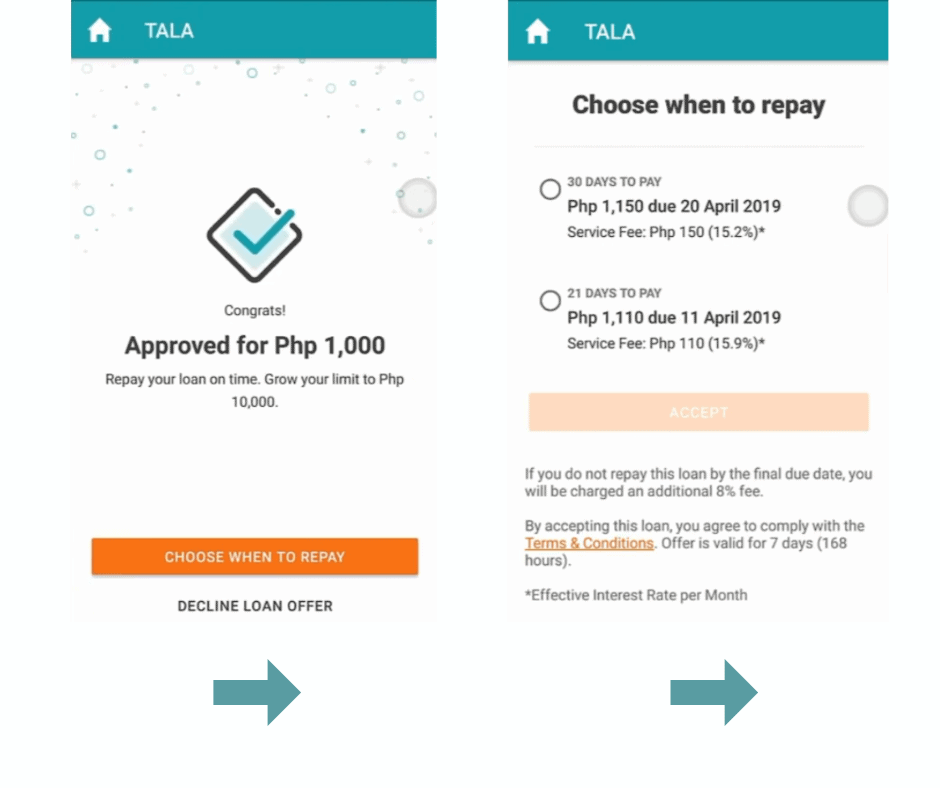

For example, if you choose a principal amount of P1,000.00 with a loan term of 30-day, the service fee would be P152.00 – P171.00, and the applicable tax would be P8.00 – P9.00, and the total amount due would be P1,160.00 – P1,180.00.

Borrowers can select between these one-time repayment terms.

Tala Philippines has a one-time late payment fee of

- 8%

Since taking a loan comes with great responsibility, so be responsible and pay on time. It will not only help you avoid unwanted payments but paying on time will also give you a good credit history record.

How to be Eligible for Tala Philippines Loan

To be eligible for Tala Philippines loan, you should meet these qualifications listed below.

- You must be a Filipino citizen

- Your age must be between 21 years old – 60 years old.

Note: Tala Philippines loan offer is not available for OFWs that are currently living outside the country. But if you are currently in the place where Tala is available (Mexico, India, and Kenya), then you are welcome to apply as long as you pass their qualifications or you are eligible to take for their loan.

Tala Philippines Loan Requirements

If you want to apply here at Tala Philippines loan, you need to present and prepare the following:

- Android Phone

- Valid Government Issued ID

And the following are the Valid IDs that Tala accepts:

- SSS ID

- UMID

- Voter’s ID

- Passport

- Driver’s License

- Postal ID

Note: Tala Philippines app is only available on Android phones that are 4.1 and above.

How to Apply at Tala Philippines Loan

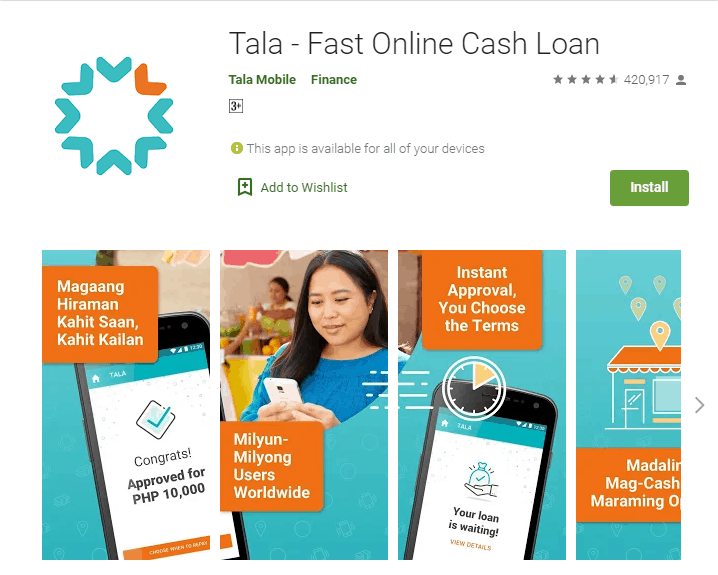

To apply for Tala Philippines, you need to download their mobile app first available at Google Play Store.

If you are interested and you want to try Tala Philippines, kindly click here.

You can follow these easy steps while applying for Tala Philippines loan.

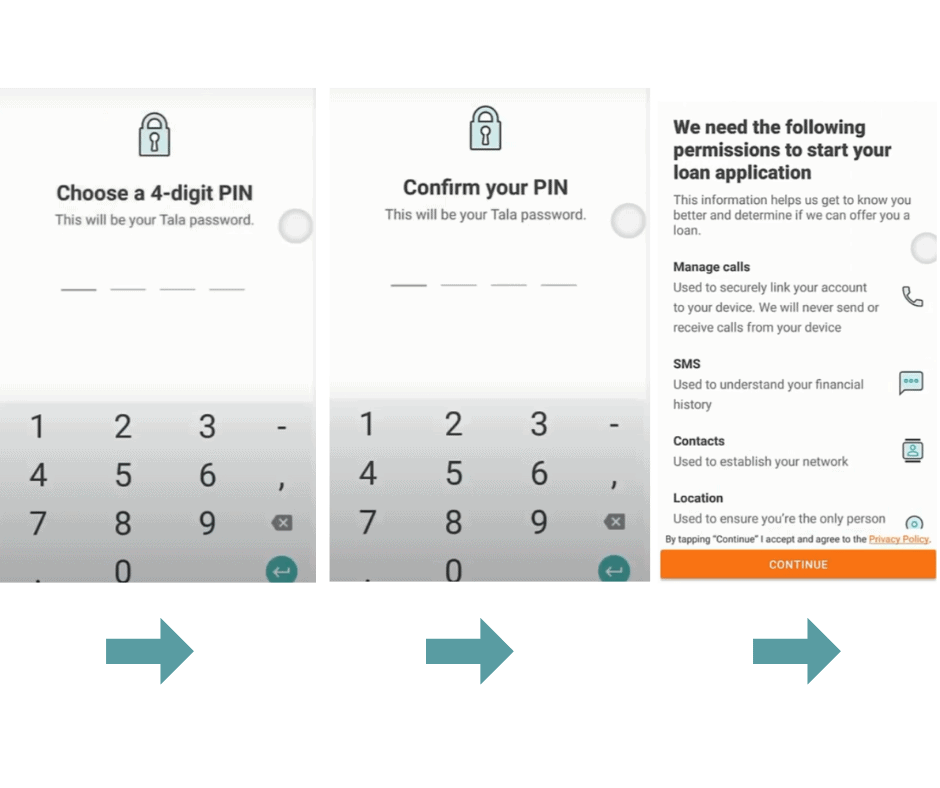

Step 1 Download and Install Tala Philippines app.

Open the app and click SIGN UP.

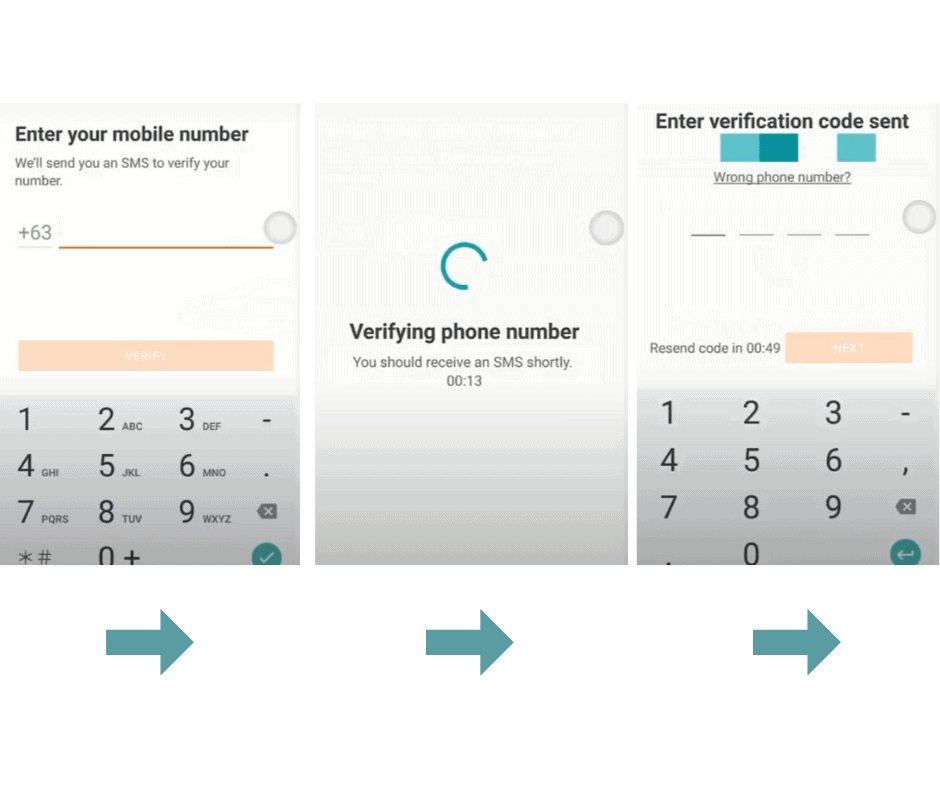

After that, you need to provide your mobile number for Tala Philippines will send you an Activation Code or OTP.

This may take at least 15 seconds before you receive the activation code. You just need to wait.

Input your activation code/OTP and click NEXT

After that, you will set your own digit pin twice.

Tala will ask for phone access permission. If you want to proceed with your loan application, you need to click ALLOW/CONTINUE.

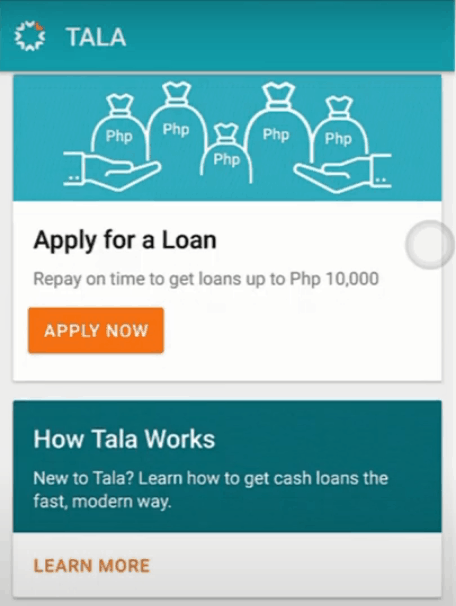

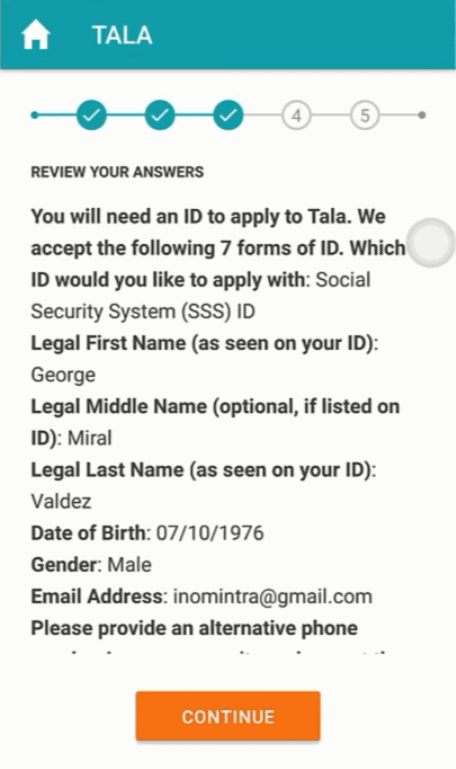

Step 2 Filling up Loan Application

Click APPLY NOW to proceed with your loan application.

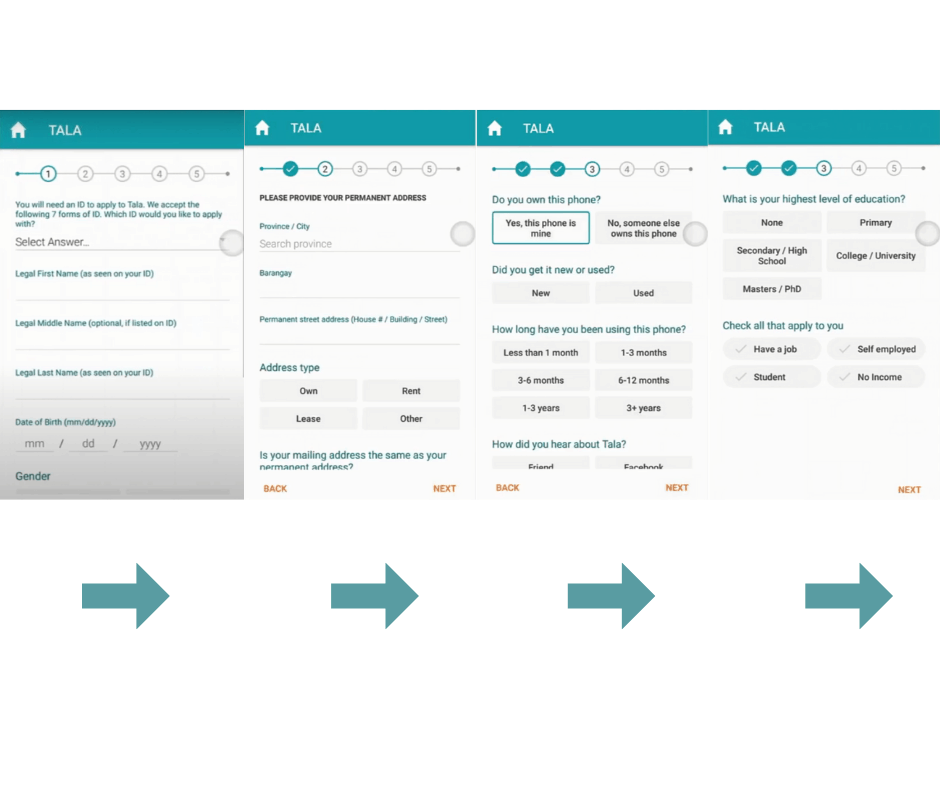

Here you will provide:

- Personal Information

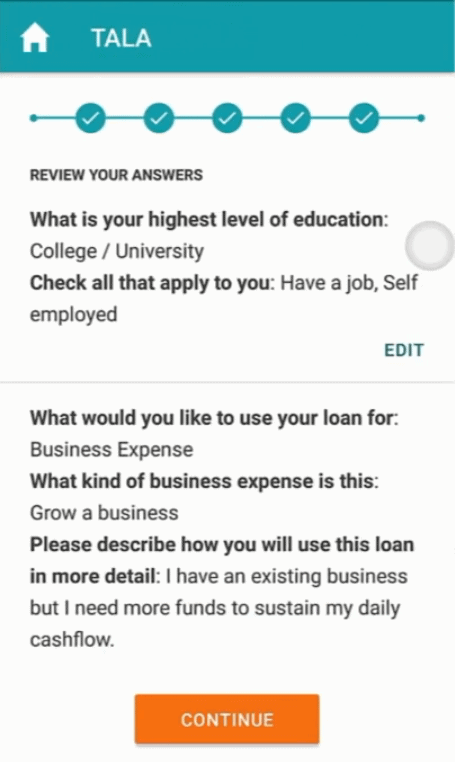

After filling up, Tala Philippines will show you the breakdown of your personal information. Here you can check for some errors or incorrect information or even a single letter. If you see some mistakes, make sure you go back and correct them to avoid future problems.

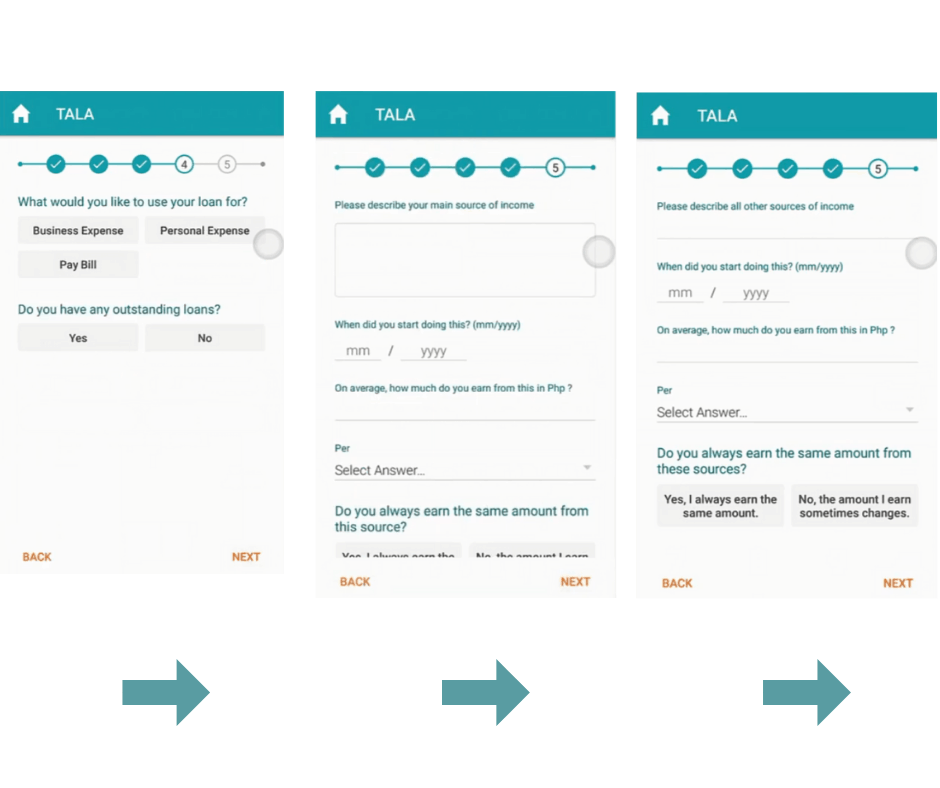

- Work or Source of Income Information

After filling up, Tala will show you again the breakdown of your Source of Income information. Again, double-check the information you provide and make sure there are no mistakes or typos to avoid problems or rejection of loans due to incorrect information.

Step 3 Mode of Payment

You have two (2) options on when you want to repay your loan.

You can choose between 30 days or the 21 days loan term.

Choose wisely!

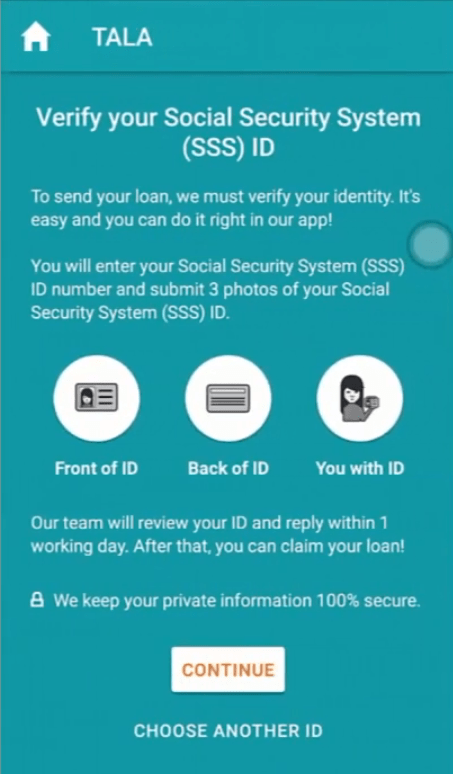

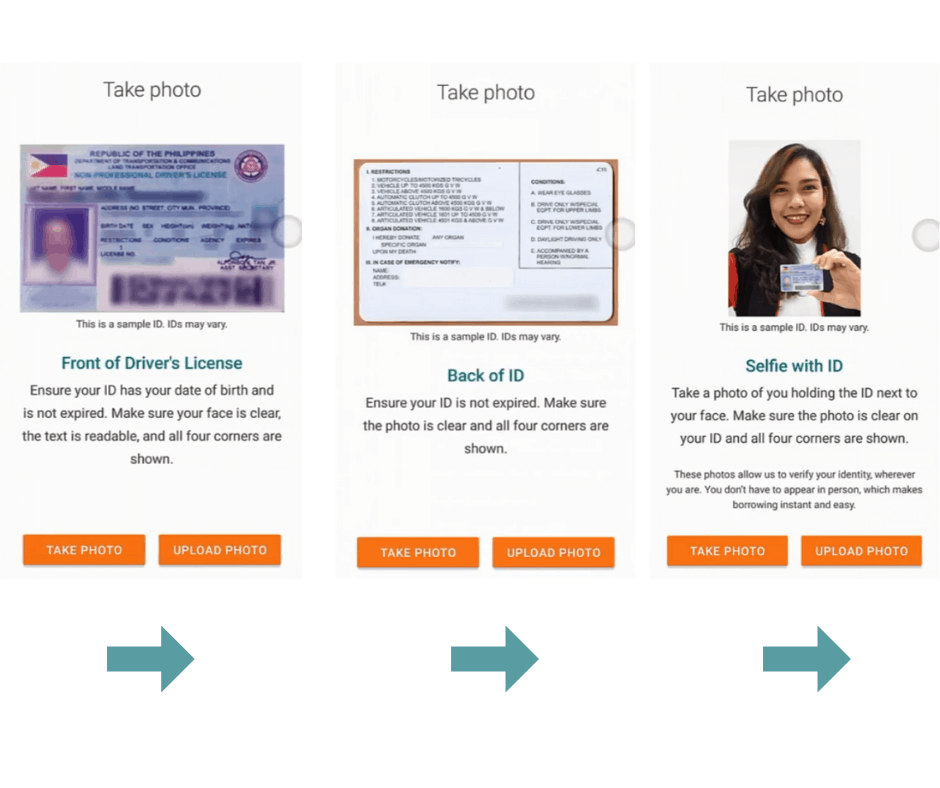

Step 4 Verification

After filling up, the next step would be presenting your Valid ID for verification.

If you are using the Valid ID, you provided at the start of the application. Then you can click CONTINUE. If you wish to use another ID, click CHOOSE ANOTHER ID and select the Valid ID you desire to use.

You need to provide three (3) pictures of your Valid ID.

- Front of ID

- Back of ID

- Selfie while holding your submitted ID

Just follow the instructions given and make sure that there is proper lightning while you take the picture and make sure everything is clear and the information in your ID is readable.

Tip: Choose a plain or white background for your Valid ID photo. In that way, Tala Philippines system can read and recognize your information clearly.

Before you click “SUBMIT PHOTOS”, make sure that the ID number you inputted is correct.

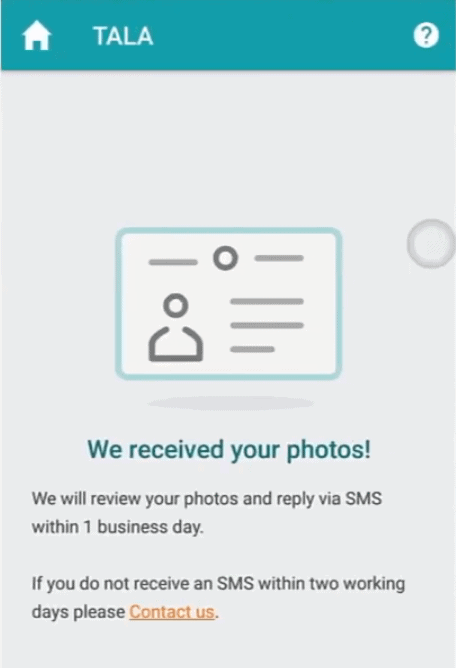

After you submit, Tala will notify you that they will review your photos, and you need to wait for at least 1 working/banking day before Tala will send you via SMS the result of your loan application.

Suppose you have waited for more than two (2) days. You can contact Tala Philippines to tell them your problem.

If you want a video tutorial, just watch this.

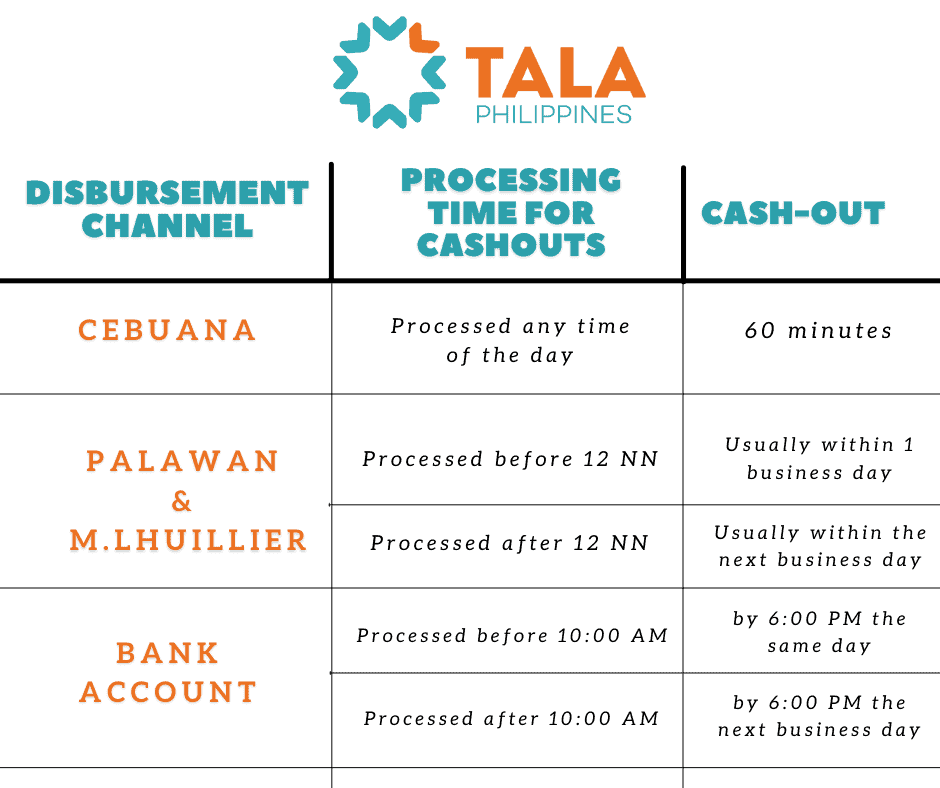

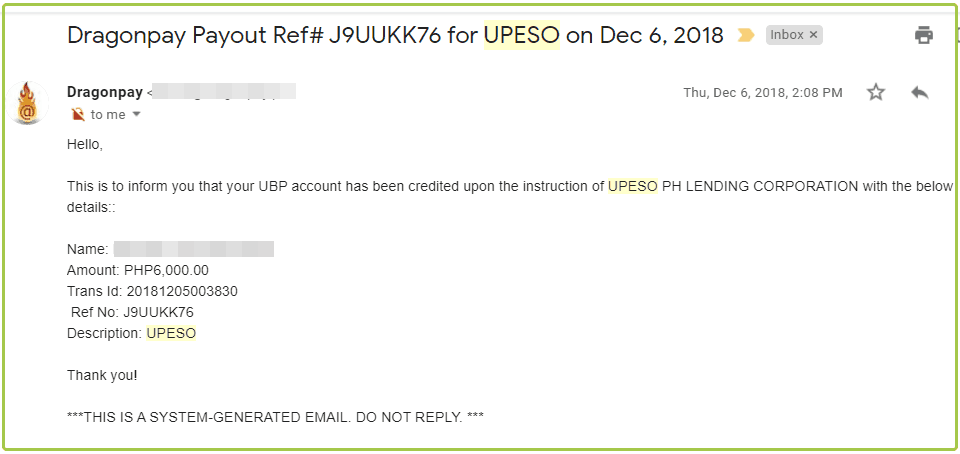

When and How can you Get the Money After Approval

If your loan application is approved, Tala will send your cash to your preferred cash-out option.

You can select at these options:

- Padala Centers

- Cebuana

- Palawan

- M.Lhuillier

- Palawan

- Bank account

- Coins.PH app

Tala Philippines will send you the following information when you claim your loan.

- Sender’s Name

- Sender’s Number

- Sender’s Address

- Exact Amount

If you haven’t received this information, you can message Tala via their app or through email so that they can provide that information.

Note: Once your loan has been disbursed, Tala Philippines will no longer allow you to change the cashout channel. Make sure you have finalized your decision before you click or select your desired cashout channel.

Padala Centers processing time for cashouts

Note: Banks do not disburse funds on weekends and holidays. If you got approved during holidays/weekends, you could get your funds on the next banking days.

To cash out on Coins.PH, kindly Refer to this link for instructions.

If you experience trouble getting your money, kindly refer to this link for troubleshooting.

How and Where to Pay Tala Philippines Loan

You can pay your loan at these repayment channels:

- 7-Eleven

- GCash

- Cebuana

- M.Lhuillier

- Coins.Ph

Note: Tala Philippines will only allow these channels for the repayment process. The payment that is not made through these channels will not be processed.

- During repayment, log-in to your Tala app and follow this payment instruction:1. Click the “Make A Payment” button on the Tala app home page.

2. Enter the AMOUNT you need to pay, then click SUBMIT

3. Select your preferred payment method:

Cebuanna (Payment details will show in the Tala app and the validity period of the reference number)

- M.Lhuillier (You will receive an SMS with the payment link)

- Coins.PH (You will receive an SMS with the payment link)

- 7-Eleven (Payment details will show in the Tala app and the validity period of the reference number)

- GCash (Payment details will show in the Tala app and the validity period of the reference number)

4. Use the reference number Tala Philippines provided during repayment. Just follow the instructions in the app to settle your loan payment.

Note: The reference number Tala Philippines has sent only has a validity of 8 hours. If it passes 8 hours and you haven’t still used the reference number, it will expire. In this case, you can contact Tala Philippines and ask for a new reference number.

After the payment is complete, you will receive a notification via SMS and in your Tala app. Tala Philippines will apply for your payment as soon as you pay. However, delays may happen sometimes. If this will happen, you only need to wait for at least 24 hours for Tala to apply for your payment.

If you have already waited over 24 hours and your payment haven’t reflected yet, you can contact Tala Philippines and provide the following information:

- A clear picture of your payment receipt

- A clear picture of the Coins confirmation message

- Invoice ID

- Amount

- Date

- Time (payment was made)

Want to pay early or advance? Yes, you can! There are no penalty fees for paying early. In fact, if you pay early and on time, this can help you qualify for larger loans on your next borrow.

What do Other People Say About Tala Philippines Loan Service

These are some of the feedbacks of those who have tried Tala Philippines loan service. We choose the latest reviews to show you the up-to-date performance of Tala Philippines. We also select both negative and positive comments to show transparency.

From what you have seen, Tala Philippines customers have different experiences. Others are satisfied while others are not.

If you look at the reviews on their app at Google PlayStore, you can see that most feedback is positive. It looks like Tala Philippines has a lot of satisfied customers. They have, by far, the highest rating of loan service satisfaction among other online lendings.

If you want to read more reviews about Tala Philippines loan service, just click here.

Loan Alternatives

Aside from Tala Philippines, other online lendings also offer fast cash. They also only require a Valid ID, and it is easy to qualify for a loan. These are the following.

- Robocash Online Loans – Offers loan for FREE for all first-time clients!

- Online Loans Pilipinas – Offers the first loan for free! 0% interest if you pay your first loan on time.

- KVIKU – You can loan a minimum amount of P1,000.00 and a maximum of P25,000.00

- MoneyCat – 100% online application, and you only need 1 Valid ID to apply!

- JuanHand – Get your cash in 5 mins.!

For more list of online lendings that offer quick cash, you can check it here.

If you are looking for a loan offer where you can loan higher amounts, you can try Banks Personal Loan as an alternative. The following banks offer high loanable amounts with low-interest rates and long terms. You can also check them out.

- Security Bank Personal Loan – You can loan a minimum amount of P30,000.00 and a maximum of P2,000,000.00 with a monthly add-on interest of 1.39% – 1.69%. They have a flexible loan term of 12 up to 36 months.

- CIMB Bank Personal Loan– You can loan a minimum amount of P30,000.00 and a maximum of P1,000,000.00 with a monthly add-on interest of 1.12% up to 1.95%. They have a loan term of 12 up to 60 months.

- PSBank Flexi Personal Loan-You can loan a minimum amount of P20,000.00 and a maximum of P250,000.00 with an interest rate of 2.5% for a revolving loan and 1.75% for a fixed loan. They have a loan term of 24 up to 36 months.

- HSBC Personal Loan-You can loan a minimum amount of P30,000.00 and a maximum of P500,000.00 with a monthly add-on interest of 0.65%. They have a loan term of 6 up to 36 months.

- Maybank Personal Loan-You can loan a minimum amount of P50,000 and a maximum of P1,000,000.00 with a monthly add-on interest rate of 1.3%. They have a loan term of 12 up to 36 months.

For more list of banks that offer personal loans, you can check it here.

Disclaimer: These pieces of information are all based on our thorough research on different platforms. We gather this information and made this Tala Philippines loan review to give you guides and ideas on Tala Philippines loan service. We are not promoting Tala, nor they partnered with us to promote their service. Applying is your own decision, and we are not reliable with any damage or loss.

Source: Tala Philippines Website, Tala Philippines Mobile App

First loan 0% fees 97% recommended Repayment: Up to 30 days Age: 21-70 years old Up to P25,000 Best Choice |

Interest Rate 0% at first loan 98% recommended Repayment: Up to 30 days Age: 20-65 years old Up to P20,000 Super Fast |

Waiting Time Instant Approval 95% recommended Repayment: Up to 180 days Age: 21-70 years old Up to P20,000 Best Loan |

Pingback: JuanHand Online Loan - Offers Fast Cash and You Can Get Your Cash in 5 mins.! - Pinoy Moneys

Pingback: Top 5 Legit Fast Cash Loan App in the Philippines in 2021 - Pinoy Moneys

Pingback: Loan Ranger Review: Is Loan Ranger PH Online Cash Loans Legit? - Pinoy Moneys

Pingback: TOP 8 Best Cash Loan Apps Philippines 2022