Are you looking for a personal bank loan with a low interest rate? Then add Hongkong and Shanghai Banking Corporation (HSBC) Personal Loan to your list.

With a low monthly add-on interest rate, the HSBC loan offer is a good option. Not only can it help fund your personal needs, but you can pay off the loan in affordable monthly payments as well.

Whether it’s bill payments, funding education expenses, home upgrades and repairs, HSBC Personal Loan is undoubtedly a great help.

Read more, to know how to be eligible and avail of HSBC Personal Loan service, what are their terms and feature, their requirements and so much more.

HSBC Personal Loan Feature

Here at HSBC personal loan, you can loan an amount with a minimum of P30,000.00 and a maximum of P500,000.00 or 3x of your monthly gross salary (whichever is lower).

Also, note that the loan amount to be granted will be subject to the bank’s credit view and final approval. Make sure you have a good credit history if you want them to approve whatever amount you will choose.

HSBC bank offers a flexible loan term. You can choose between 6, 12, 24, and 36 months. And just what we said earlier, HSBC offers a low monthly add-on interest rate of as low as 0.65 per month. So affordable!

The completion of loan application and requirements here at HSBC Bank usually takes five (5) up to seven (7) days, and it will take another two (2) to three (3) days to get your cash.

If you can’t wait that long, try Banks Personal Loans with a short application process instead, such as CIMB Bank Personal Loan. If you are looking for a loan for an emergency need, you can choose online lending that offers fast cash with lesser requirements.

How to be eligible for HSBC Personal Loan

To be eligible or qualify for HSBC Personal Loan, you should meet these qualifications listed below.

- Must be a Filipino resident here in the Philippines for at least three years.

- Age must be at least 21 – 60 upon loan maturity.

- Monthly income must be at least P14,000.00 or P50,000.00 if you are self-employed.

- Must have a bank account

- Must be employed for at least two (2) years

- You should have an active mobile number or a landline.

These are the basics. If you put a check on all of the lists, you are qualified for HSBC Personal Loan. Feel free to apply and avail of their loan service.

HSBC Personal Loan Requirements

If you want to apply for HSBC Personal Loan, you need to present the following.

FOR EMPLOYED

- 1 Valid ID

- Proof of Address

- Your Latest Income Tax Return (ITR)

- Your Latest Monthly Payslip

- Signed T&C

FOR SELF-EMPLOYED

- 1 Valid ID

- Proof of Address

- Certificate of Registration

- Your Business Official Permit

- Bank Statements for the Last Three (3) Months

- Your Income Tax Return (ITR) and Annual Financial Statements (AFS) for the Previous Three (3) Years.

How to apply for HSBC Personal Loan

If you want to apply for HSBC Personal Loan, you need to go to their branch where forms are available.

Sadly, as of now, the HSBC loan application is not yet available online. Although they have a mobile app, you can’t apply for a loan here. Their mobile app can only help with operations such as money transfers, deposits, bills, balance checks, etc.

But don’t lose hope. Someday it may be available online, especially during these pandemic times where the digital process is the most convenient.

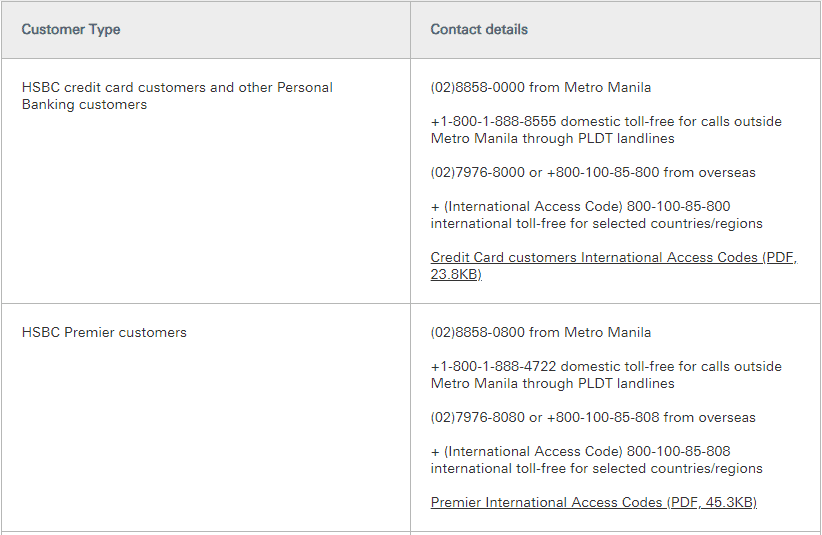

If you want to apply for HSBC Personal Loan, you can contact them first via telephone.

You can call this number.

Before going to their branches, make sure you have a robust immune system to fight back Covid-19 (or its new variant) and follow all the safety protocols.

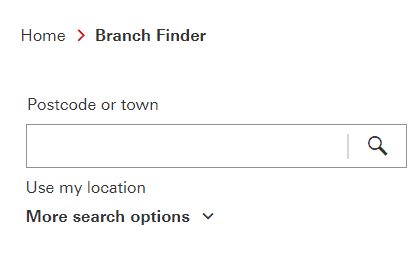

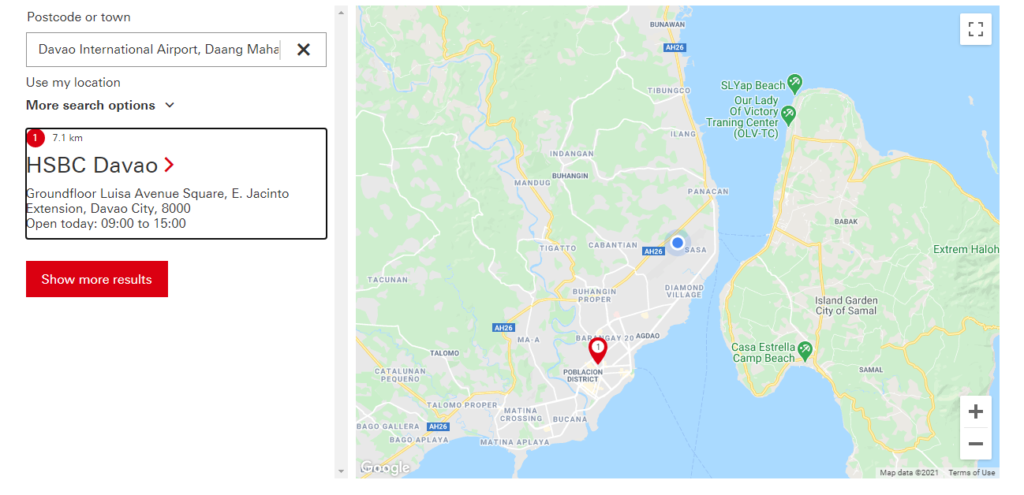

HSBC has 26 ATMs and Branches here in the Philippines. To know the nearest branch, you can visit their website and type your location, then viola! – the nearest branch near you will appear with a corresponding map, branch working hours, and contact number.

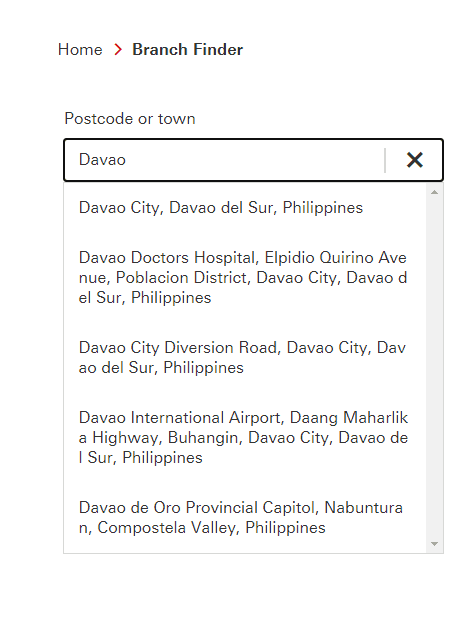

For example, If I will type Davao, several locations will appear. You can choose from the provided list below and choose the place near you or type your complete address.

After you choose your location, they will now provide the branch located near you. HSBC Bank will also provide important information like their working hours, a map, and contact number (you can see that if you will click the branch name).

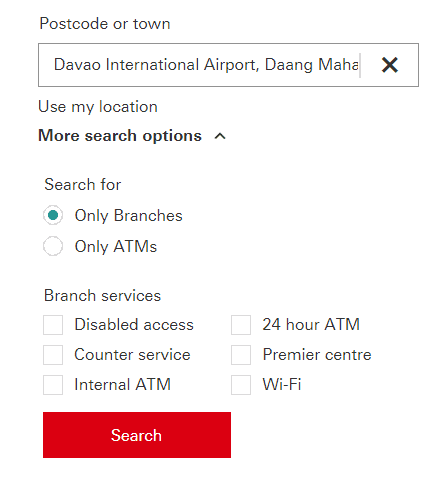

If you want to filter and be more specific on what you are looking for, click “more search option.”

Easy, right? If you want to know HSBC Bank located near you. You can click here. Also, HSBC Bank branches are closed during holidays.

If you don’t want to risk your life going outside with Covid-19 still out there looking for a victim, then you can apply with the comfort of your home. PBCOM, Maybank, PSBank, and CIMB Bank are some of those banks that offer personal loan where you can apply online.

What are HSBC Personal Loan Requirements

HSBC Bank doesn’t provide the information or the list of requirements on their website. To know their loan requirements and for other queries, you can contact them here at (02) 8858-0000 if you are from Metro Manila. For other locations, you can contact them at the provided contact number when you search their branch near your areas.

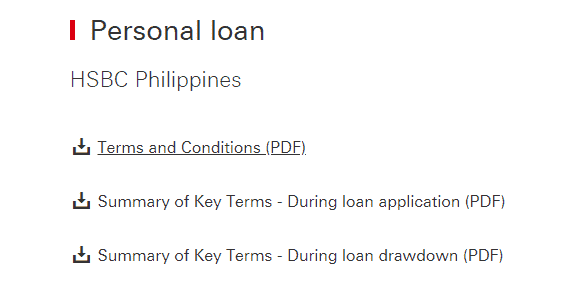

Although, HSBC doesn’t provide the list of requirements. But they do provide an important form you might consider reading before proceeding with the loan. Since you are availing for HSBC personal loan, you might need to scan these three (3) forms.

For other list of forms, you can check it here.

HSBC Personal Loan Fees and Charges

HSBC has a processing fee of P1,500.00 that will be deducted from loan proceeds. A Documentary Stamp Tax of 0.75% of the drawn loan amount will also be deducted from loan proceeds. But, if you will loan an amount up to P250,000.00 used for personal purposes, it will be exempted from DST.

There is also an Amendment Fee of P500.00 after drawdown and a late payment fee of 36% per annum. If you don’t want to pay more than what you need to pay, then settle your payables on time.

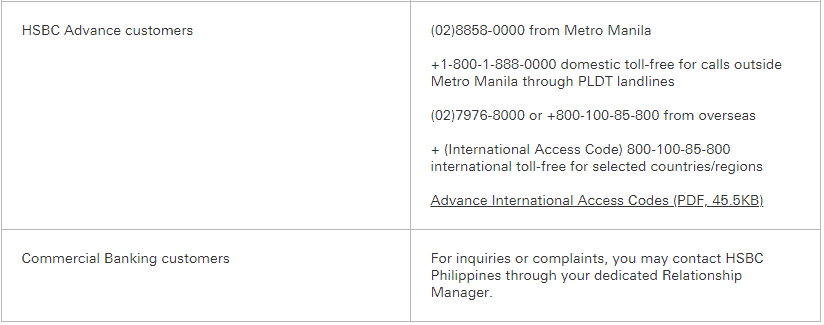

For more information, queries, or even complaints. Feel free to contact HSBC and let them know how they can help you.

You can also send them an email or even write to them.

Hongkong and Shanghai Banking Corporation (HSBC) is an entity regulated by the Bangko Sentral ng Pilipinas. If you want to know more information or for queries, you can also get in touch with Bangko Sentral ng Pilipinas (BSP) Consumer Empowerment Group through thru these.

Email: consumeraffairs@bsp.gov.ph

Facebook: https://www.facebook.com/BangkoSentralngPilipinas

SMS: 09021582277

Source: https://www.hsbc.com.ph/loans/products/personal/

First loan 0% fees 97% recommended Repayment: Up to 30 days Age: 21-70 years old Up to P25,000 Best Choice |

Interest Rate 0% at first loan 98% recommended Repayment: Up to 30 days Age: 20-65 years old Up to P20,000 Super Fast |

Waiting Time Instant Approval 95% recommended Repayment: Up to 180 days Age: 21-70 years old Up to P20,000 Best Loan |

Pingback: Maybank Personal Loan - 1 of the best and lowest interests in the Philippines! - Pinoy Moneys

Pingback: PSBank Flexi Personal Loan - 1st and only personal loan with revolving credit line and fixed term - Pinoy Moneys

Pingback: CIMB Bank Personal Loan- 100% Online Transaction in Just 10 Minutes and Get Approval as Fast as 24 hours! - Best loan offer! - Pinoy Moneys

Pingback: Robocash Online Loan Philippines - Best Loan App That Offers 0% Interest For First-time Borrower. - Pinoy Moneys

Pingback: Online Loans Pilipinas - 0% Interest Rate for First-time Borrower. Try their service for FREE! - Pinoy Moneys

Pingback: PBCOM Personal Loan - Offers as low as 1.68% per month. Apply online for FREE! - Pinoy Moneys

Pingback: Security Bank Personal Loan - Collateral FREE and Co-maker FREE! Offer as low as 1.69% monthly add-on interest per month. Best Loan Offer! - Pinoy Moneys

Pingback: MoneyCat Loan - Quick Cash Online Lending - Offers 0% Interest For All First-time Borrower - Get Your First Loan Here For FREE! - Pinoy Moneys

Pingback: CashXpress Philippines Review - Offers Quick Cash with 0% Interest for All First-time Borrowers. - Pinoy Moneys

Pingback: Fast Cash Loans Review - Only Need 1 Valid ID to Apply! - Pinoy Moneys

Pingback: Lendpinoy Loan Review - Get Quick Cash Online with Zero Processing Fee and FREE of Charges! Only Need 1 Valid ID to Apply - Pinoy Moneys

Pingback: IPeso Loan Review - Offers Instant Cash Online with 1 Valid ID Only! - Pinoy Moneys

Pingback: CashJeep Loan Review - Get Fast Cash Online with 1 Valid ID Only! - Pinoy Moneys

Pingback: KVIKU Loan Review - Loan Approved in as Quick as 24 Hours! Apply Now and Get Your Cash Online. - Pinoy Moneys

Pingback: Tala Philippines Loan Review - Fast Online Cash Loan - Apply now with 1 Valid Only! - Pinoy Moneys

Pingback: Cashalo Loan Review - They Offer 3 Best Loan Products - Cashaloan, Lazada Loan, and Pay With Cashalo. Apply Now! - Pinoy Moneys

Pingback: UnaPay Loan Review - Shop Now and Pay Later Via Installment here at UnaPay! - Pinoy Moneys